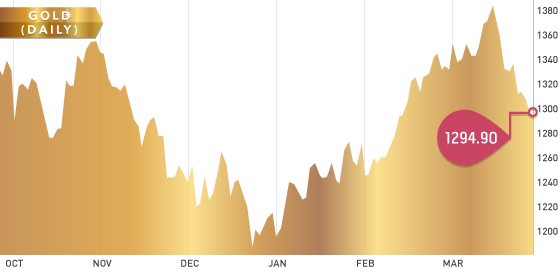

It was a fairly quiet week for precious metals. After closing at $1,336 last Friday, gold finished this week down 3.2% and closed at $1,293.80. Silver closed at $19.79, down 2.6% on the week. Gold exchange-traded products continue to experience net inflows with 9.6 metric tons added so far in March. Physical demand is expected to be strong on any further drop in prices as bargain hunters are likely to step in. Gold traders will be watching economic data late next week to determine the next course of action. Preliminary forecasts have indicated the employment rate will drop next week, which would be negative for gold.

Gold Support at $1,280 | Gold Resistance at $1,320

Gold Chart

Platinum strikes continue in South Africa and loss of production is estimated at ~10,000 ounces per day. The market has not been too worried about the strikes so far with the platinum price hitting a high of $1,256 and since pulling back. The producers knew the strike was coming months beforehand so they were able to stockpile ounces in preparation. The strike has been ongoing for ten weeks now and total losses are $4.6 billion Rand for employees and $10.5 billion Rand for employers. It’s interesting to note the platinum price was ~$1,453 when the strike started (January 22nd) and it closed Friday (March 28th) at 1,409.90. Investors looking for a way to play platinum and palladium could look at the Sprott Physical Trust.

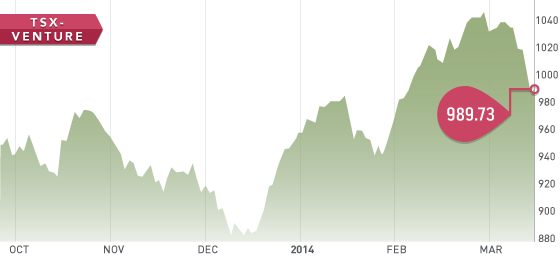

It was a tough week for the TSX Venture as it looks like sellers have begun to take some profits on the bounce from the beginning of the year. April will be a very interesting time for many of the junior exploration companies, as audited annual financials are due to be filed. The bill for these audits is not cheap and runs between $20,000 and $100,000. It will be interesting to see how the month of April plays out, but we would expect to see some weakness on the TSX Venture.

We have seen three to five press releases per day talking about junior mining stocks moving into the marijuana business. This, in our opinion, is a bubble that investors should be very wary of.

TSX-V Chart

A Look Ahead

Next week is an important week for economic data. The important news will come later on in the week with the European Central Bank meeting next Thursday. Friday will be a big day for traders with U.S. employment data coming out.

We are excited to be releasing a Tickerscores Top 10 report next week. There’s been a lot of hard work put into this report and it will feature an in depth look at eight precious metals companies and two non-precious metals bonus stocks.

Analyst portfolio performance: A tough month for March with performance down 9.22%. Overall YTD, the portfolio is up 25.01%.

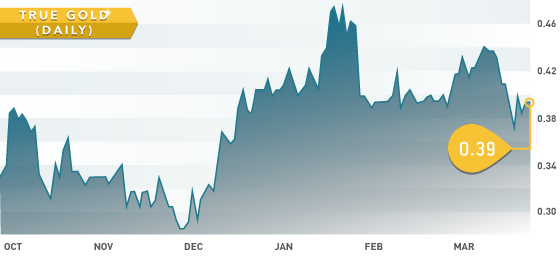

Symbol: TGM.V

Symbol: TGM.V

Price: $0.39

Shares Outstanding: 397,570,228

Market Cap: $155.05m

This week we take a look at True Gold Mining, a gold developer in Burkina Faso, West Africa. CEO Mark O’Dea, who also happens to be the CEO of last week’s featured company, Pilot Gold (PLG.T), leads True Gold. True Gold has a fantastic project with robust economics that make for a good investing choice in a volatile gold market. The Karma gold project will be a low-cost, open pit, heap leach mine.

Highlights of the feasibility study include a $131.5 million CAPEX, 43.1% IRR, $178.2 million NPV, and a 1.4 year payback period. The study was done at $1,250 gold so tremendous leverage is available in a rising gold price environment. True Gold has $70 million in cash and is expected to close a debt financing for $90 million to fund mine construction. Construction is expected to start in Q4 this year with first production at the end of 2015.

Investors should not ignore True Gold with the proven track record of management and an excellent project.

Mark O’Dea on the Karma project:

“In our view, Karma is one of the premium development-stage, shovel-ready projects globally due to its low-cost production attributes, strong growth profile, metallurgy and jurisdiction. We have already built the foundation to become a leading mid-tier gold producer, including the receipt of key mining permits and a strong treasury to fund development, with North Kao clearly demonstrating the potential to boost our production profile.”

MAR