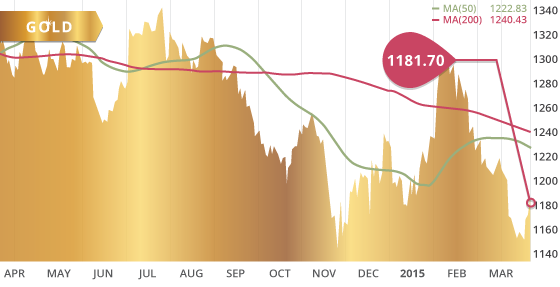

Gold

Gold was up $23.30 or 2% on the week to close at $1181.70 an ounce, thanks in large part to the outcome of the FOMC meeting. Despite removing the word “patient” from their statement, the FOMC signalled that they are in no rush to raise rates and that they will not be “impatient” in doing so. The committee lowered their growth forecast for 2015, which caught the market off guard, resulting in a sell-off of the dollar and buyers re-entering the gold sector.

Despite the mini-rally, the move in gold was not particularly substantial, since the market feels the eventual rate-hike is imminent and the current weakness is not enough to derail their expectations. In this regard, the impending rate-hike will continue to weigh on gold until there is a clear change in direction by the FOMC. Therefore, gold’s movement going forward will be very sensitive to the economic data points out of the U.S., as these will reveal to the market if conditions are improving enough for the Fed to raise rates or not in the immediate future. If the data is showing continued weakness then gold will continue to be supported, and vice versa. We do not expect any major short-term move in gold unless there is a dramatic shift in the language of the FOMC, a significant U.S. economic trend indicated by the data, or a consequential geopolitical event.

There was a declining trend line from the high on February 3rd that presented resistance around the $1180 area, yet was broken on Friday. However, gold met resistance at a 2-week declining trend line, which the metal bounced off of on Friday. This trend line as well as an additional trend line from the January high may have the metal contained short-term unless there is some data out in the next week or two that helps push the metal higher.

There is also a cluster of resistance marks above the $1185 area up to the $1260 level. However, in the event that gold is able to plough through this range, then the metal will be looking to break through a 19-month declining trend line around the $1280-$1290 area, and to push above the $1307 high of January 22nd. We have multiple indicators turning bullish on the hourly chart, including the 50-hour MA having crossed above the 200-hour MA on Thursday for the first time since early March. Minor support comes in around the $1160 level (200 hour MA). However, below this area solid support for the metal remains at the $1142 level.

With much of the market misjudging what the economic data has been signalling and therefore what the outcome of the FOMC meeting would be, speculators had cut their net long positions to their lowest since December 31 2013, and cut their positions by the largest amount since June 2007. This data was for the week ending March 17th, a day before the FOMC statement, so we expect these numbers to change in favour of gold for the subsequent reporting week.

The near-century old London Gold Fix was discontinued after Thursday, with the new Fix commencing Friday morning. The new Fix is comprised of 6 banks: Barclays, HSBC, Societe General, Scotia Bank, UBS, and lastly Goldman Sachs. There is expectation that a Chinese bank will join at some point in the future, a scenario which could provide a gold fix more representative of Asian demand for gold. The new Fix is supposed to offer greater transparency and mitigate market abuse. US regulators are investigating at least 10 banks in regards to precious metals trading, and have already subpoenaed HSBC. In other news, China announced further reforms in the opening up of its gold bullion market.

Technicals:

- Support: $1,159.55

- Resistance: $1,208.46

- 50 day moving average: $1,222.83

- 200 day moving average: $1,240.43

- HUI/Gold Ratio: 0.144 (Last week 0.139)

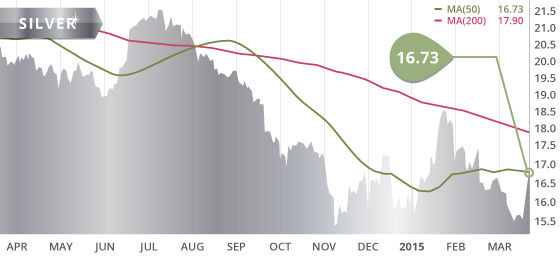

Silver

Silver was up 7% on the week to close at a one-month high of $16.73 an ounce. The fact that silver bounced off the $16.89 mark on the dot shows that the market is paying attention to the technical indicators of the metal. We still see $16.89 as near-term resistance this week, however, if the metal is able to break through this level it will be looking towards the $17.30 mark, which is an area to keep a close eye on. There are multiple resistance marks in that area that will provide a challenging hurdle for the metal. Minor support comes in at $15.80 this week, however if the metal drops below this mark, solid support remains at the $15.51 area where the metal has seen continuous support over the past few months.

For the sixth week in a row, speculators cut their net long position in silver to their lowest since late-November. However, with the turn of events on Wednesday, we’re sure there was some short covering that will change this 6-week trend when the latest numbers are out on Friday.

Technicals:

- Support: $15.80

- Resistance: $16.89

- 50 day moving average: $16.73

- 200 day moving average: $17.90

- Gold/Silver Ratio: 70.63

- XAU/Gold Ratio: 0.0586 (Last Week: 0.0566)

Platinum

Platinum broke through the $1100 level to an intraday low of $1,086.70 on Tuesday, yet managed to claw back above $1,100 while joining the rally in precious metals following the FOMC statement on Wednesday. The metal closed at $1137.50, up $19.70 on the week. This may be a temporary bounce for platinum since there still remains significant downward pressure in the market. We don’t expect the price to extend much further, and expect platinum to eventually fall back below $1,100 once again. The $1086 area marks near-term support, however below this area solid support is seen around the $1060 level. This $1060 area coincides with the near 14-year ascending trend line mentioned last week.

Technicals:

- Support: $1,086.20

- Resistance: $1,149.70

- 50 day moving average: $1,198.14

- 200 day moving average: $1,307.93

The TSX and the TSX-V were both up on the week thanks to a rally in the commodities. This is particularly true for the precious metals sector following the FOMC statement. The TSX closed up 1.43% and the TSX Venture was up just shy of 1%. Although the Venture was down to start the week while putting in a 3-month low during intraday trading on Tuesday, the rally in commodities on Wednesday helped to put the Venture back into positive territory.

The mining sector was up 4% on the week, gaining back most of the ground lost during the week prior. The gold sector was up 4.4% to make back some of the recent losses, but is still down 15% from the January high. Meanwhile, the base metal sector was up 2.7%, with net long positions in copper growing to their highest level since early September.

The US dollar index pulled back upon the FOMC statement, but quickly rebounded the following day. Despite the rebound, the dollar strength did not weigh on the gold price, as gold held steady around $1,170. The dollar was sold off again on Friday erasing most of the gains made the day prior and helping to push gold to a 2-week high.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday March 23

- Existing Home Sales (US) – Consensus: 4.90M

- GDP YoY (RUS) – Consensus: -1.5%

Tuesday March 24

- HSBC Manufacturing PMI (CHN) – Consensus: 50.5

- Manufacturing PMI (GER) – Consensus: 51.5

- CPI MoM (UK) – Consensus: 0.3%

- Core CPI MoM (US) – Consensus: 0.1%

- New Home Sales (US) – Consensus: 470K

Wednesday March 25

- Core Durable Goods Orders MoM (US) – Consensus: 0.3%

Thursday March 26

- Markit Services PMI (US) – Prior: 57.2

- Initial Jobless Claims (US) – Consensus: 290K

- Basket of Economic Data (JPN)

Friday March 27

- GDP QoQ (US) – Consensus: 2.4%

- MI Consumer Expectations (US) – Consensus: 84.0

- MI Consumer Sentiment (US) – Consensus: 92.0

- Core PCE Prices (US) – Consensus: 1.10%

Following the FOMC meeting last week, the markets will focus their attention heavily on the economic data out of the U.S., to gauge if the moderate recovery is in fact starting to soften. The FOMC revised much of their outlook to the downside for 2015 and the market will now securitize the near-term data more heavily. This week the important items on deck will be the core inflation, core durable goods, as well as the GDP numbers. Durable Goods has been showing us that the American consumer is not buying, and coupled with the weakness of exports as a result of the strong dollar, are both contributing to the lack of shipments. The housing numbers are also very important moving forward, especially after last week’s dismal numbers. The housing recovery in the U.S. has been very sluggish, and is not showing any signs of that changing.

Last Week: The main event last week was the FOMC meeting which revealed that despite removing the word “patient” from their statement, the FOMC is recognizing the soft economic data coming out of the U.S., and as a result, have lowered their growth forecasts for 2015. This has forced the market to re-evaluate the condition of the U.S., and focus much closer on the data going forward.

In other events last week, the U.S. Empire State Manufacturing slowed, and the Philly Fed Manufacturing fell to a 13-month low. Industrial Production was up slightly, though largely as a result of the cold weather increasing output by utilities. However the broad trend is showing modest growth in the economy with much of the data continuing to show that the economy has softened in the last two months. Building Permits fell to their lowest in almost a year, while housing starts plummeted to their lowest since 2011.

Canada released weak inflation data and disappointing retail sales on Friday. However, the market quickly shrugged off the data and re-joined the broad based sell-off in the U.S. dollar. The Canadian dollar was up 1% on Friday despite the weak numbers, and was up 1.8% on the week.

Top 10 Updates:

Probe Mines (PRB.V) announced that following the completed acquisition by Goldcorp, the new spin off company began trading on the TSX Venture on March 17th under the new name Probe Metals Inc. and under the same ticker symbol.

Rockhaven Resources (RK.V) announced this week that they have arranged a $4.41 million financing with Strategic Metals Ltd. (SMD.V) by offering 21 million shares at $0.21 per share with no warrants attached. The proceeds of the offering will be used to finance additional exploration at Klaza following their initial resource estimate released in January.

-

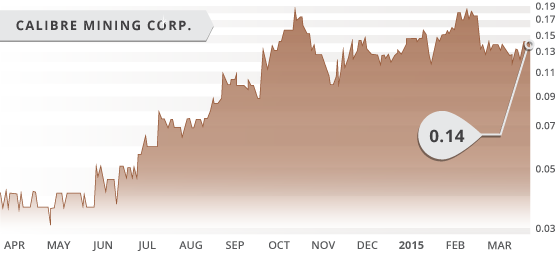

- Symbol: CXB.V

- Price: $0.14

- Shares Outstanding: 222,910,918

- Market Cap: $31.2 Million

- Cash: $2.7 million in working capital

- Significant Shareholders: B2Gold Corp. (13.5%), Pierre Lassonde (11%), Management (9%)

Note: Calibre Mining is not currently covered in the Tickerscores database.

Calibre Mining (TSX VENTURE:CXB) is a gold exploration company focused on a portfolio of high-quality projects in Nicaragua called the Borosi Concessions. They have a joint venture with IAMGOLD on the Eastern Borosi Project, a JV with B2Gold on the Primavera Project, and a JV with Alder on the Rosita Project. The company also holds a 100% interest in the Siuna Project, which contains a number of targets, including the Montes de Oro skarn target. With all of these projects active the company has a lot of irons in the fire, and a lot for an investor to monitor and understand in terms of property developments. However, with three of these irons funded by earn-in agreements, the company is able to see their projects developed in a challenging financing environment, without having to go to the market.

The company and their assets are clearly generating interest, considering the involvement of their 3 joint venture partnerships, but also from strategic investors. B2Gold holds 13.5% of the shares, and gold mining legend Pierre Lassonde holds 11.2% of the shares. Mr. Lassonde’s daughter Julie became a director of the company only a few short months after her father took his strategic investment in the company. Meanwhile management has significant skin in the game holding 9% of the shares. The large share count of the company is somewhat of a concern, with 223 million shares out and 257 million fully diluted. The majority of the option and warrant overhang is between 15 and 18 cents.

Eastern Borosi

The Eastern Borosi Project is a low sulphidation epithermal gold-silver deposit that contains a series of northeast trending gold-silver bearing structures. The company entered into a JV agreement with IAMGOLD in mid-2014, whereby IAMGOLD can earn 51% by spending $5 million over 3 years. In the second half of 2014 a 5,500m Phase I drill program was completed on the project, with final results released in January. The first-phase drilling resulted in numerous high-grade intercepts including hole GP14-003 and hole GP14-010. Hole 3 returned 6.03 meters grading 14.39 g/t and 14.51 g/t of gold and silver respectively. Hole 10 returned an impressive 12.9 meters of 8.73 g/t and 11.48 g/t of gold and silver respectively. With IAMGOLD clearly encouraged by the results, the company immediately announced in early February that a follow up Phase II drill program had commenced on the property. This program will consist of a minimum 5,500 meters of drilling with a budget of $1.5 million. We expect initial assay results by mid-April.

Primavera/Minnesota

The Primavera and Minnesota Projects are also demonstrating encouraging results, however the results subsequent to the impressive first hole at Primavera in January of 2012 have clearly not inspired the market. Nonetheless, B2Gold seems satisfied with the results so far, and is continuing to put money onto the ground. The initial trenching results from Minnesota in early-2014 were very encouraging. However the reconnaissance drill program aimed to test these results in late-2014 was not as encouraging, and in the end did not confirm the promising trenching results. The project is still at an early stage, and there is still much more development ahead. B2Gold has the option to earn in another 19% for a 70% interest by incurring $6 million in additional exploration expenditures by April 2016. If B2Gold elects to spend the $6 million over the next year, it would help indicate the value and potential at Primavera and Minnesota. However, if they decide to remain with a 51% stake, then perhaps we can deduce that there is not a lot of upside left in the projects to move the share price.

Montes de Oro

The company has been recently advancing the Montes de Oro Gold Skarn Project with geophysical and geochemical surveys, as well as rigorous trenching. The trenching results have displayed a high-grade system with impressive grades over significant lengths such as trench MTR13-009, which was extended to a length of 52.3 meters grading 7.07 g/t of gold and 1.23% zinc. Trench MTR13-017 was extended to a length of 27.5 meters grading 4.93 g/t of gold. These are very encouraging initial results and will need to be confirmed by drilling. Calibre announced that an initial drill program for Montes de Oro is planned for April. Confirmation of the high-grade gold displayed by the trench result would help support the share price and possibly attract another joint venture partnership. However, they key thing for investors to look for is high-grade results over considerable lengths. High-grade trench results are not indicative of what is occurring beneath the surface, although it does provide some smoke to drill test.

The company is in a stable financial position with $2.7 million in working capital, but will likely need to raise additional funds later in the year to continue exploration at their 100% owned properties. Along with exploring in Nicaragua comes the political risk factor, which is evidently priced into the market cap. However, in their latest survey the Fraser Institute ranked Nicaragua 63rd out of 122 countries, which is a large jump from last years place at 94. This is comparable to Colombia and Panama, which were ranked 58th and 65th respectively.

Bottom line

We feel that with the positive results coming from both the Eastern Borosi JV as well as from the 100% Montes de Oro Project, their developments offer potential catalysts to move the share price. The large number of shares outstanding will somewhat dampen the gains form successful exploration, although this issue would subdued with any substantial discovery. In an environment where financing is challenging to obtain, Calibre is clearly in an enviable position having 3 JV partnerships developing Calibre’s properties on their dime. This allows Calibre to preserve cash and mitigate dilutive financings. With four projects being advanced simultaneously, it also increases the odds of potential near-term value creation for shareholders.

Potential Catalysts and Events to Monitor:

- Montes de Oro Maiden Drill Program (April 2015)

- Eastern Borosi Phase II Drilling (Currently Drilling)

- Primavera/Minnesota Developments

MAR