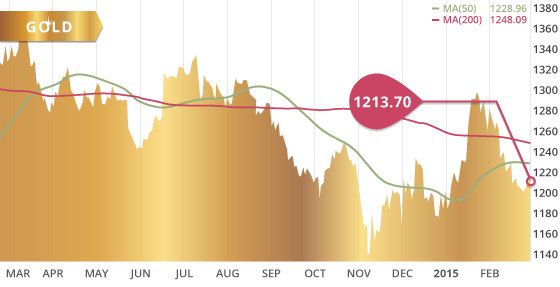

Gold

Gold was up moderately last week, increasing $10.40 to close at $1213.70 an ounce, a small correction of the past month’s declines. Although gold put in a fresh 7-week low during intraday trading on Tuesday, the metal found support and rebounded for the rest of the week. Gold traded in a $20 range for most of the week between $1190 and $1210, with buyers continuing to show up to support the price along a 1-month declining trend line.

The gold price strengthened on Yellen’s testimony Tuesday after she gave little clues to the proximity of rate hikes, and gave a more dovish tone then the market was expecting. Her commentary pushed back the markets’ expectations of a mid-year rate hike. The two key indicators that the FOMC is looking for improvements before making a rate decision are inflation growth and wage growth. We saw dollar weakness across the board for the first half of the week which was supportive of gold. However, with the CPI data on Thursday showing signs of wage growth, the markets put a mid-year rate-hike back on the table. The U.S. dollar strengthened and in the process stifled gold’s rally at $1220, with sellers showing up to apply downward pressure to the price. However, the following day, GDP numbers out of the U.S. were weaker then initially forecast in January, which once again had the market pushing back the prospect of a mid-year rate-hike.

The technicals seem to be improving for gold, although this week will be a week that will either make or break this early trend. With the non-farms payrolls out of the U.S. next week, the data will drive the gold price to the downside if the numbers are as positive as they were last month. The most important figures to watch will be the wage growth and participation rate.

The gold price had positive price movements towards the end of the week, crossing above the 200 hour MA. The 50 hour MA also crossed above the 200 hour MA on Friday for the first time since late January. The $1198 retracement mark will provide support going forward, after holding up well last week. There is also an ascending support line that will provide further support in the range of $1185-1190. The gold price was within $5 of testing this 3 ½ -month trend line on Monday and Tuesday but buyers stepped in both days and pushed the price back up.

The latest CFTC data showed gold long-positions have declined for the third consecutive week, which is evident by the declining gold price. On Saturday China cut it’s benchmark rate amidst numerous other policy measures to stimulate their economy, these measures should move the metals markets to start the week. Gold was also supported at the end of the week when India announced that they were maintaining the current import tax on gold at 10%. Industry expectations were for a reduction in the tax and had many Indian buyers deferring the buying of the metal until the expected tax reduction took place. Now that there was no tax decline as expected, Indians will be rushing to buy the gold they deferred, in preparation for the upcoming festival season.

Technicals:

- Support: $1188.13

- Resistance: $1,225.25

- 50 day moving average: $1,228.96

- 200 day moving average: $1,248.09

- HUI/Gold Ratio: 0.158 (Last week 0.153)

Silver

Silver was up slightly last week to close at $16.58. Despite a brief breach of the $16.80 level on Thursday sellers quickly emerged at $16.88 and push the price back down. We will watch this week to see if buyers can overwhelm sellers at the $16.80 level. If so, the next resistance mark for silver is at the $17.45 level. The $15.90 level held last week and may provide support once again in the near-term. However, the $15.50 level provides solid support should the metal break below this near-term support.

Technicals:

- Support: $15.51

- Resistance: $16.80

- 50 day moving average: $16.74

- 200 day moving average: $18.14

- Gold/Silver Ratio: 73.20

- XAU/Gold Ratio: 0.0634 (Last Week: 0.0617)

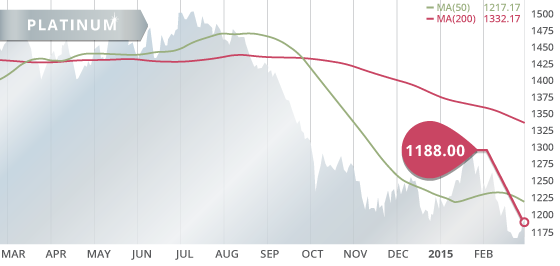

Platinum

Platinum had a strong finish to the week closing up $24.20 up 2.1%.

With the recent policy actions taken by China, including Saturday’s rate cut, coupled with the improving manufacturing data out of China, the platinum sector should get a bit of a boost from these developments. There is solid resistance around the $1215 level with much overhead in the $1215-$1230 range. For now, weak support remains at the mid-February low.

Technicals:

- Support: $1,1150.00

- Resistance: $1,215.00

- 50 day moving average: $1,217.17

- 200 day moving average: $1,332.17

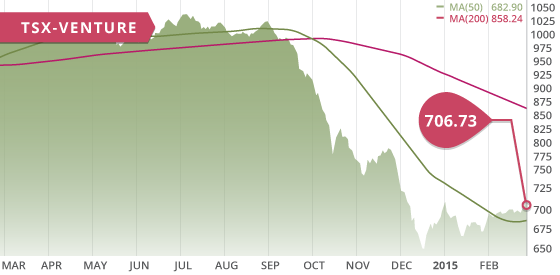

The TSX-V rose to a 7-week high of 706.73 with metals and energy sectors improving slightly. The TSX continued to exhibit strength mostly on the back of solid earning reports from the big banks, but also in part to the metals and mining sector, in particular the gold sector.

Oil remains below $50 as data out in the week showed U.S. inventories at their highest level in 80 years, and also as the decline in U.S oil and gas rig count has begun to drop at a slower rate then the markets would like to see.

Copper rose to a six-week high on the back of the positive manufacturing data out of China. Copper closed the week at $2.69 and looks to continue to strengthen with the improving manufacturing data out of China and their recent policy decisions to stimulate their economy. The resource sector is certain to react positively to these recent events in China.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday March 2

– ISM Manufacturing PMI (US) – Consensus: 53.1

– Personal Spending (US) – Consensus: -0.1%

Tuesday March 3

– Interest Rate Decision (AUS) – Consensus: 2.00%

– GDP MoM (CAN) – Consensus: 0.2%

Wednesday March 4

– ADP Employment Change (US) – Consensus: 220K

– ISM Non-Manufacturing PMI (US) – Consensus: 56.5

– Interest Rate Decision (CAN) – Consensus: 0.75%

Thursday March 5

– Interest Rate Decision (EA) – Consensus: 0.05%

– Initial Jobless Claims (US) – Consensus: 295K

– Challenger Job Cuts (US) – Prior: 53.0K

– Factory Orders (US) – Consensus: 0.3%

Friday March 6

– Nonfarm Payrolls (US) – Consensus: 240K

– Average Hourly Earnings (US) – Consensus: 0.2%

– Balance of Trade (US) – Consensus: $-42B

This week the markets attention will be on the nonfarm payrolls out of the U.S. of Friday, focusing particularly on the hourly earnings growth, and the participation rate. With the weak manufacturing data out of the U.S. lately, the market will be closely eyeing the manufacturing and non-manufacturing numbers as well as factory orders. Also of note will be the multiple rate decisions by the BoC, ECB, and RBA. The BoC and the RBA recently cut their benchmark rate, however, it is not expected that they will cut once again.

Last Week: Yellen’s testimony was very tepid and gave no clear indication of a near-term rate hike. The Chairs tone was more towards the cautious side, and indicated the Fed is still concerned about wage growth, lack of inflation, and the global growth slowdown. The FOMC’s concerns were further supported this week by a number of soft data points out of the U.S. Existing Home Sales came in below expectations and in the process reached a 9-month low, and Pending Home sales also came in below consensus. This is yet another indication of the choppy housing recovery in the country. However, New Home Sales were slightly higher then expected.

Consumer confidence also came in lower then expected, though on the other hand, Services PMI came in higher then expected. The durable good orders came in stronger then expected, although there were a few data points within the report that caused questions. One of these being the consistently increasing inventories within the U.S. alongside the recently decreasing shipments. This relationship has pushed the inventory to shipments ratio to just shy of a 5-year high. These will be important numbers to watch going forward to see if those number improve or not. Weaker exports and weak consumer buying in the U.S. are both factors in the declining shipments. This may prove to have residual implications in the all important jobs data in the coming months. Initial jobless claims rose last week to a 5-week high, which was the second highest number in 3 months. We will see if this weak jobs number is reflected in the nonfarm payrolls this week.

Core CPI came in line with expectations, although the data showed an unexpected increase in wage growth, which the had the market reacting and putting the prospect of a June rate-hike back on the table. However on Friday, GDP growth out of the U.S was well below the 2.6% initial estimate in January and tempered the markets rate-hike expectations once again.

Bank of Canada’s Poloz’s comments strengthened the Canadian Dollar this week, as he indicated that Canada’s recent rate hike was a precautionary measure and not one necessarily out of necessity. Meanwhile, China Manufacturing PMI came in above expectations and showed the sector expending for the first time since October.

Mexico developers update has been delayed slightly, as we wanted to include the fourth quarter financials of any companies releasing before the end of the month (February). We now have the financials we need, as of Friday, although roughly half of the companies Q4 financials will not be out for another month since their fiscal year ended at the end of Q4. At that point we will re-update this category with those numbers included. However, this initial update will be out at the end of the week or early in the week following.

Top 10 Updates:

Kootenay Silver (KTN.V) announced this week that phase II drilling has commenced on their new La Negra silver discovery. The company will drill approximately 30 holes, with initial results expected by mid-April.

Dalradian Resources (DNA.TO) announced that 9.56 million warrants had been exercised prior to their expiry on Feb. 19th, resulting in proceeds of roughly $8.6 million. In combination with the $11.3 million investment with Ross Beaty two weeks prior, Dalradian has added roughly $20 million to the $37 million the company had at the end of Q3.

Montan Capital Corp. (MO.P) announced this week that shareholders of both Montan Capital Corp and Strait Minerals have voted in favour of the planned merger.

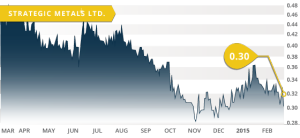

- Symbol: SMD.V

- Price: $0.30

- Shares Outstanding: 87,388,851

- Market Cap: $26.5 Million

- Cash: $34 million (As of Sept. 30th)

- Significant shareholders: Tocqueville (14.3%), Condire Investors, LLC (13.4%), Management & Board (7.3%)

Note: As a prospect generator, Strategic is not currently covered in the Tickerscores model.

Strategic Metals Ltd. (SMD.V) is a prospect generator with their primary focus within the Yukon Territory of Canada. The company’s model is to build value through project generation, royalty sales, property sales, and spin-outs. With interests in over 130 properties, this company has many options available to create value. With a stable financial position and a plethora of properties, this company is well positioned to weather this downturn and benefit from the next upturn in the resource sector.

Strategic is in an excellent financial position with over $30 million in cash, another $14 million in marketable securities, and no debt. At $0.30 per share, the company is trading at a discount of 40% to their working capital. Since January 2008, during these periods where the share price is trading at a considerable discount to working capital, the company has bought back close to 6.5 million shares at an average price of $0.31 per share. With this strong cash position, the company is well positioned to take advantage of the current downturn and look to acquire quality assets, and also partake in potential financing opportunities.

Strategic holds marketable securities in a number of companies, most notably an 8.6% position in ATAC Resources (ATC.V), a 19.9% position in Silver Range Resources (SNG.V), and a 32.7% position in Rockhaven Resources (RK.V). Rockhaven was previously chosen as Tickerscores stock of the week on October 26th, as well as was included in our most recent Top 10 report released in late January. As a major shareholder in these three companies, Strategic will partake in the continued success at their respective projects, which in turn will potentially increase the value of Strategic holdings and therefore in Strategic itself.

Strategic has interests in over 130 properties, including 12 royalty interests, and 6 joint ventures. The company holds a number of highly prospective porphyry targets within the prolific porphyry belt that stretches northwest from southern BC up through the Yukon. One of these properties is the 100% owned Hopper Project in the Yukon. This is a property that the company has focused on with early-stage exploration, leading to the identification of encouraging geochemical anomalies. The project also has historical drill results within a 400 by 300 meter area, which displayed notable copper and gold mineralization that warrants follow up drilling. Another highly prospective property in the portfolio is the 100%-owned Midas Touch Project, also in the Yukon. This property is contiguous to ATAC’s Rackla Project, which has discovered an emerging Carlin-style gold district.

A strong and proven management team and board are at the helm of the company. This team has a long history working in the North, and also has experience advancing projects through to the takeover stage. The company is under the Strategic Exploration Group umbrella, which provides access to in house geological consulting firm Archer, Cathro and Associates (1981). This relationship is an integral part of the Strategic umbrella, as Archer Cathro provides extensive knowledge and experience in the Yukon, Alaska, and Northern BC. The consulting firm also provides unrestricted access to their proprietary mineral database.

Bottom line

This company has the cash on hand to not only survive this downturn, but to also potentially acquire and/or finance high-quality assets that will contribute to the growth profile once we exit this downturn. Like many prospect generators, this company has an excellent model to achieve growth while maintaining a conservative share count. With their plethora of properties, strong cash position, proven management team, and relationship with exploration experts in the Yukon, Strategic Metals is well supported for long-term success within the industry.

Potential Catalysts and Events to Monitor:

- Cash Deployment: Acquisitions and Investments (2015)

- Exploration: Hopper, Midas Touch, etc. (2015)

MAR