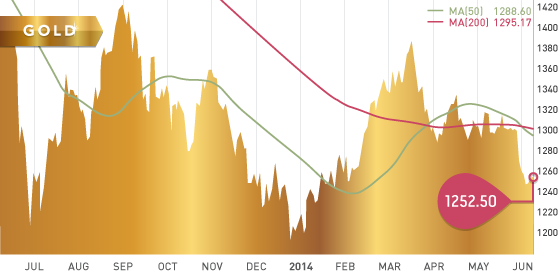

Gold closed at $1,252.50 per ounce on Friday, up $2.90 on the week. Not much action in gold this week, although on Thursday gold was up ~1% as the ECB announced a $400 billion Euro lending scheme designed to increase lending to businesses. On Friday, US employment data showed the economy adding 217,000 jobs in May and gold had little reaction. No major economic catalysts are on the horizon for next week, so we expect gold to continue trading in a tight range.

Technicals:

50-day moving average: $1,288.60

200-day moving average: $1,295.17

Support: $1,240

Resistance: $1,270

Silver

Silver closed at $19.03, up 20 cents from the previous week.

Support: $18.60

Resistance: $19.50

Platinum

After a week of talks, the strike continues in South Africa; mediation by the Mines Minister appeared to have little effect. The two parties are expected to resume talks on Monday. It appears no end to the strike is in sight anytime soon, especially with the comments below:

“There is no concession, it’s 12,500,” AMCU President Joseph Mathunjwa told reporters in Johannesburg today. “I think AMCU has been steadfast on 12,500. We moved from one year to four years, so therefore it’s up to the companies to say, ‘now it’s time to share the minerals of this country.’ There is no argument that stands.“

Mark Cutifani, CEO of Anglo American PLC, the world’s largest platinum producer, had this to say in a speech in London:

“What’s being asked, for us is unsustainable.”

A Look Ahead

The key items on the calendar this week are:

- Wednesday June 11th – US Treasury Budget

- Thursday June 12th- Unemployment claims/ Retail Sales

- Friday June 13th – Producer Price Index

All Q1 updates for producers have been made and are being sent out. Due to gold being at $1,250, it is important to note that many producers will be making a net profit. We like companies that are generating free cash flow at current prices, such as aforementioned companies like Luna Gold (LGC.T), Timmins Gold (TMM.T), and Lake Shore Gold (LSG.T).

Starting next week, we will be covering exploration and development companies for Q1, with British Columbia being the first region.

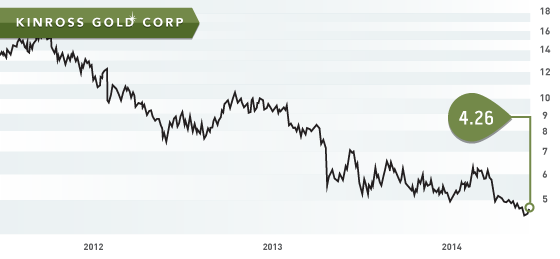

Symbol: K.T

Price: $4.26

Shares Outstanding: 1,144,382,795

Market Cap: $1,114,382,795

This week, we take a look at senior producer Kinross Gold. Kinross is one of the top 10 gold producers in the world, with 2014 production forecasted between 2.5 and 2.7 million gold-equivalent ounces. Management continues to focus on cost discipline and optimizing its nine operating mines.

First quarter performance was strong, with net earnings of $31.8 million, while producing 664,690 gold-equivalent ounces. Kinross boasts one of the lowest all-in sustaining costs in the industry, at $1,001 per ounce. Using $1,200, good free cash flow is expected this year. The balance sheet looks good with $1.7 billion in working capital, including $700 million in cash.

Kinross operates two mines in Russia, which could be part of the reason for the weakness in the share price. We do not see this as a major issue and management has stated that they have been “unaffected” at operations.

The bottom line is everything is going in the right direction at Kinross Gold, and if we get a higher gold price, shareholders will be well rewarded.

MAY