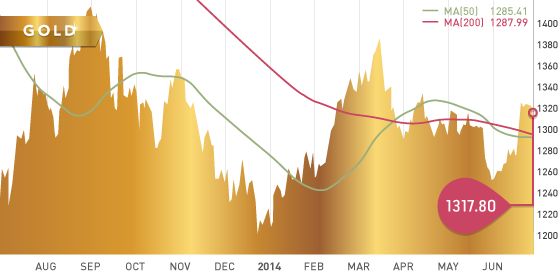

This was a quiet week for the yellow metal. Gold was up $3 from last week’s close and this week closed at $1,317.18. This week’s weaker than expected US data supported the gold price as the US dollar was under pressure. America’s first quarter GDP came in lower than expected, dropping 2.9%. Traders continue to monitor the situation in Iraq, as well as technical indicators. Respected market analyst, Charles Nenner, has noted that the gold price has closed above the 10 day moving average, which is bullish from a technical standpoint. Next week is a short trading week and the big catalyst will be the US unemployment rate, released on Thursday.

This was a quiet week for the yellow metal. Gold was up $3 from last week’s close and this week closed at $1,317.18. This week’s weaker than expected US data supported the gold price as the US dollar was under pressure. America’s first quarter GDP came in lower than expected, dropping 2.9%. Traders continue to monitor the situation in Iraq, as well as technical indicators. Respected market analyst, Charles Nenner, has noted that the gold price has closed above the 10 day moving average, which is bullish from a technical standpoint. Next week is a short trading week and the big catalyst will be the US unemployment rate, released on Thursday.

Technicals:

- Support: $1,300

- Resistance: $1,331

- 10- day moving average: $1,300.78

- 50-day moving average: $1,285.41

- 200-day moving average: $1,287.99

Silver This was the fourth consecutive green week for silver, closing at $21.02 per ounce. Silver is now at a 14 week high, reaching levels last seen on March 18th. We believe silver has bottomed here; if it can break above $22, it will move higher.

Support: $20.47

Resistance: $21.50

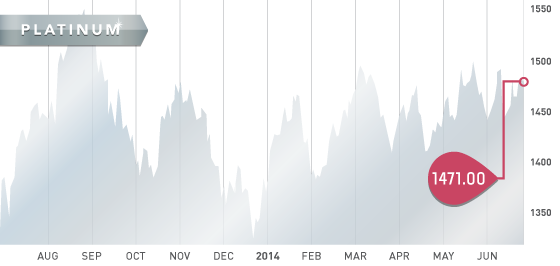

Platinum

After five months, the strike is officially over, with both parties coming to an agreement on June 24th. Workers are already back at work and companies are hoping to get up to full production as soon as possible. However, a return to full production could still take up to 3 month. Amplat’s CEO, Chris Griffiths, has stated he expects his company to be at “meaningful” production levels in two weeks. In the end, the miners settled for annual raises up to 20%. The raise will put more stress on the producers’ balance sheets, as it was estimated that half of South Africa’s platinum shafts were losing money before the strike.

We remain bullish on platinum price and our favourite stock is Stillwater Mining (SWC).

An interesting article, titled “South Africa: Who won the Platinum Strike? The Figures Speak,” can be found here.

A Look Ahead

The key items on the calendar this week are:

- Monday – June 30th – Chicago PMI

- Tuesday – July 1st – Canadian markets closed (Canada Day)

- Thursday – July 3rd – US unemployment rate / Employment data

- Friday – July 4th – US markets closed (Independence Day)

BC development companies are complete.

BC development companies are complete.

Pretium (PVG.T) and Seabridge (SEA.T) continue to hold the top spots. Pretium has one of the highest grade undeveloped gold projects in the world. The grade of the project leads to robust economics, even at $1,100 gold. Seabridge has one of the largest undeveloped gold projects in the world, but it is low grade. Seabridge’s management is excited by developments occurring at the Deep Kerr zone and will be aggressively drilling this summer.

Ontario exploration companies are in progress and will be complete soon. Initial results look bleak, as companies continue to struggle raising money and creating shareholder value.

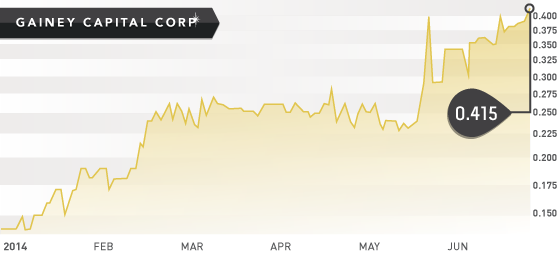

- Symbol: GNC.V

- Price: $0.415

- Shares Outstanding: 42,987,954

- Market Cap: $16,765,000

This week, we take a look at a Mexican toll mining company, Gainey Capital. Gainey Capital caught our attention with a news release announcing the completion of mill upgrades. The company will be a toll miner and its story reminds me of Dynacor Gold (DNG.T), who’s stock has performed very well in the resource downturn.

Gainey will operate the mill at 300 tonnes per day and is in the process of negotiating ore-tolling agreements. The current infrastructure would support a second 300 tonne per day mill, if enough demand occurs. They can use the revenue from toll mining to explore the El Colomo Property.

Gainey is cashed up, after closing a $2.7 million dollar financing on May 23rd. The financing was done at 20 cents, so investors will want to be careful when the four-month hold period expires. Ernesto Echavarria, a wealthy Mexican businessman, bought 6,250,000 shares in the private placement.

The bottom line is that with cash flow coming in the near future from toll mining, Gainey could be the next Dyancor. If that happens, shareholders at these levels will be in for a nice return.

JUN