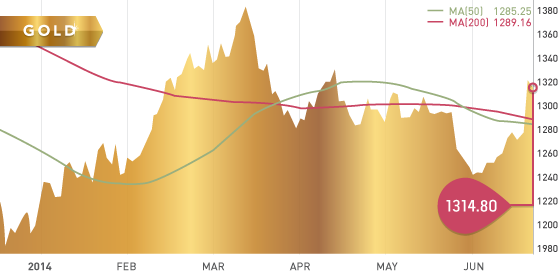

A very good week for gold bulls, as the gold price jumped up by almost $40 dollars to $1,314.18. The entire weekly move took place on Thursday and was kick started by a large buy order. The large buy order occurred during lunch, with 2.9 million ounces changing hands in three separate trades, all within fifteen minutes. Technical buying and short covering also helped move the yellow metal higher. On Wednesday, Federal Chair, Janet Yellen announced the FED was cutting back its monthly purchases by $10 Billion. Gold investor took note of the mention that interest rates will be kept low for a considerable amount of time.

Tensions in Iraq continue to escalate, which further limits the downside risk. Several pieces of US economic data will be released next week, which investors and traders will be watching.

Technicals:

50-day moving average: $1285.25

200-day moving average: $1289.16

Silver

A strong week for silver, closing $20.88 per ounce. Once silver achieved a little traction, shorts were forced to cover, which drove the price higher. Silver saw open contracts rise by 1,900 this week. This is a very strong signal silver has put in a bottom.

Platinum

The strike continues and all signs indicate that there are only a few details that need to be ironed out before a final agreement is made. Employees are now returning to the towns near the mines in preparation for mining to resume. Once miners are back to work, it is estimated to take at least three months for full production to resume.

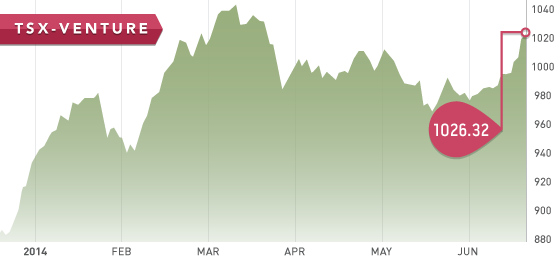

The TSX Venture continues to surprise me and finished the week at 1026.37. The exchange was pretty over sold in December, with tax loss selling and is now up 9.27% year to date. What we have happening is a fair amount of divergence between the issuers. The high quality names are carrying the exchange higher, while the lower quality names continue to struggle.

A Look Ahead

The key items on the calendar this week are:

- Monday June 23rd – Existing home sales

- Tuesday June 24th – New home sales

- Tuesday June 24th – Consumer Confidence

- Wednesday June 25th – GDP 3rd quarter estimate

- Thursday June 26th – Unemployment data

- Thursday June 26th – Personal spending data

All producer first quarter updates should have arrived in your inbox. The small junior gold producers we have pounded the table on have performed very well in the last couple of weeks (Luna Gold, Timmins Gold, and Lake Shore Gold).

BC development companies are in progress and almost done.

Top 10 report update:

An update on the remaining 5 of the Top 10 report is below.

Seabridge – (SEA.T) – Seabridge is up 17.97% since the Top 10 report was released. As noted in the report, Seabridge provides tremendous leverage to a rising gold price with the world class KSM deposit. Drilling has commenced for the 2014 season and will include 19,000m, with a focus on the Deep Kerr zone. We believe investors have not yet realized the potential of the Deep Kerr results yet, with a very respectable grade of .53% copper. A significant catalyst will be the EA/EIS decision expected in mid 2014.

Marlin Gold – (MLN.T) – Marlin continues to do exactly what we expected, as one of Mexico’s newest gold producers. Total gold production so far is 1,892 ounces, and commercial production is expected before the end of Q3. The mine ramp up has been a bit slower than initially expected. The advancement of the Golden Reign transaction is expected to close in the next couple weeks. Shareholders have approved a 10:1 rollback on the stock.

Allied Nevada – (ANV.T) – Allied Nevada squeaked out a net profit of $332,000 in Q1. The results of the Hycroft mill expansion pre-feasibility study were encouraging, with a NPV of $1.7 billion and 26.5% IRR, at $1,300 gold and $21.67 silver. The only issue here is the large CAPEX with phase 1 costing $900 million and an additional $422 million for phase 2. Allied Nevada is on pace to achieve production guidance. The biggest thing to watch regarding price movement in ANV stock is precious metal prices.

Alpha Exploration -(AEX.V) – Alpha stock has had a rough go, losing 50% in the last few months. Initial disappointing drill results and Garrett Ainsworth (VP exploration) leaving the company were the reasons for the low selling volume. Drill targets are being evaluated at three projects for winter drilling campaigns. Going forward, management still has roughly $3.5 million to work.

Mart Resources – (MMT.T) – This past week saw incredible volatility in Mart share price, with a low of $1.17 and a high of $1.80. Mart is hosting its AGM in Calgary this afternoon and I will be joining via webcast. A press release this week provided an update on corporate activities. We remain very bullish on Mart stock, especially as the Umugini pipeline finishes construction and begins commissioning. Investors who can deal with the risk of Nigeria would be wise to take a look at Mart stock at current levels ($1.50).

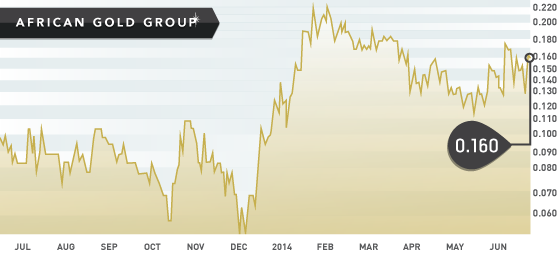

Symbol: AGG.V

Price: $0.16

Shares Outstanding: 159,170,308

Market Cap: $26.2 million

This week, we take a look at a gold development company, African Gold Group. African Gold Group owns the Kobada Gold project in Mali, which is moving forward to production, hopefully in 2016. The Kobada project has a resource of 2.3 million ounces at .88 g/t. The management’s goal is to produce 50,000 ounces per year by 2016. Management owns approximately 10% of the stock and has experience in Africa.

The second half of 2014 will provide investors with a couple catalysts that have potential to move the stock. The first catalyst will be a pre-feasibility study that is expected in August 2014. We expect the economics on this project to be favourable, as the PEA in July 2011 was excellent with a low CAPEX of $122 million and an IRR of 90%. A final feasibility study is expected in November.

Projects with low CAPEX and simple mining with high IRR will be in demand. African Gold appears to be on the right track and if the feasibility studies support this, the company is definitely worth more than a $26 million market cap.

JUN