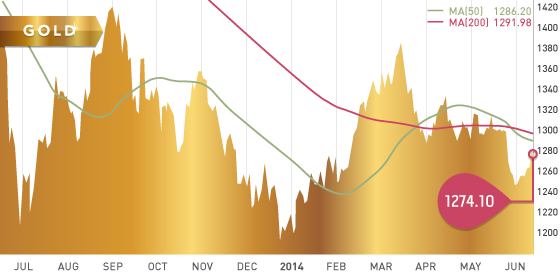

Gold had a solid week, closing at $1,277.40 per ounce. The major contributing catalyst for gold this week was the rising geopolitical tension in the Middle East. Traders and investors in the yellow metal will be keeping a close eye on the FOMC meeting next Wednesday. If gold can move a little higher, it will be back close to the 50 and 200 day moving averages.

Technicals:

50-day moving average: $1,286.20

200-day moving average: $1,291.98

Support: $1,250

Resistance: $1,285

Silver

Silver closed at $19.67, up 64 cents from the previous week. This is the second straight positive week for silver.

Support: $18.97

Resistance: $20.00

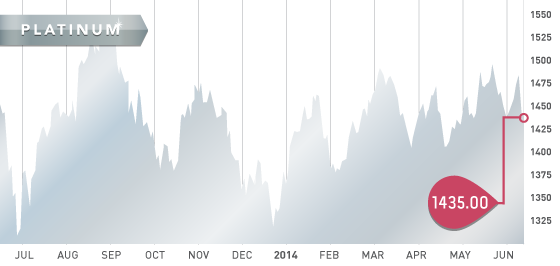

Platinum

Surprising news on Thursday, as it appears the AMCU and platinum producers are very close to reaching an agreement. AMCU will be meeting its members over the weekend and the producers are hoping employees will return back to work next week. Platinum producer, Lonmin, has stated once employees return, it will take a few weeks before mining commences. We still see upside potential in the platinum price, as it will take months for mines to resume full production.

Platinum is down -1.73% year-to-date and you can see the volatility in the chart below.

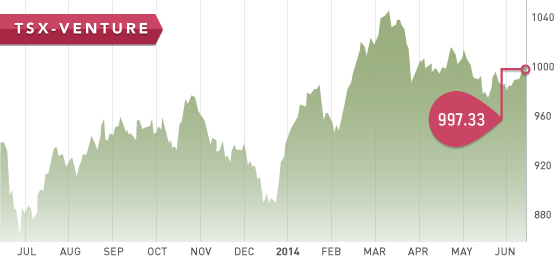

The TSX Venture ended up finishing at 997.33 pts. The TSX V was helped by higher commodity prices this week, particularly oil. We continue to be bearish on the TSX Venture, as 90% of the companies are doing nothing to create any shareholder value. Our opinion is that the TSX Venture needs a good cleansing and has more downside to come this summer. As the TSX V bottoms out, we will see fantastic buying opportunities. The TSX continues to push higher, coming close to record highs of 15,073.13, reached in June of 2008.

A Look Ahead

- The key items on the calendar this week are:

- Monday June 16th – Industrial production

- Tuesday June 17th – Housing data/ Consumer Price Index

- Wednesday June 18th – FOMC rate decision

- Thursday June 19th – Unemployment claims

First quarter updates have been hitting your inbox from all producers. Some of the names we mentioned last week, Timmins Gold (TMM.T) and Lake Shore Gold (LSG.T), had nice moves this week with the rising gold price. Luna Gold continues to lag and we believe is still good value at these levels.

BC exploration companies (Q1) have been scored and will be sent out soon. Initial results look bleak, with many companies low on cash and not doing anything to create shareholder value. Following BC exploration companies, we will be doing BC development.

Top 10 report update:

An update on 5 of the Top 10 report is below. The remaining five will be updated in next week’s Weekly Trends.

Prosper Gold (PGX.V) – Prosper raised $3 million of the $4 million they wanted and commenced field work the first week of May. Drilling began on May 20th at the Star target, so we should expect initial assays sometime in the next 4-6 weeks. A second drill rig is expected to be brought in sometime this month to test the Pyrrhotite Creek target, which is 4.5km southwest of the Star target.

Garibaldi Resources (GGI.V) – Garibaldi has moved up to 22 cents from 17 cents when the report was issued. The reason for the move was an exceptional high-grade silver intercept at the Rodadero project in Mexico. A step out hole commenced immediately and we should expect results fairly soon. Garibaldi still has plans to drill at its highly prospective claims in British Columbia this summer.

Columbus Gold (CGT.V) – Columbus continues to let JV partner, Nord Gold, work away on the Montagne d’Or gold deposit. Drilling on the project continues wit 56 holes completed in the Phase 2 program. Columbus received a $4.2 million dollar payment from Nord on May 21st as part of the option agreement. A new resource estimate on the project is expected to be out this month.

Probe Mines (PRB.V) – Probe recently released a 43-101 underground resource estimate for the Borden project. The underground resource estimate was 1.6 million ounces indicated at 5.39 g/t and 430,000 indicated ounce at 4.32 g/t. When you add in the open pit, Probe has roughly 4.3 million ounces. A 40,000 m infill-drilling program is underway. A 5,000 m exploration-drilling program on the East Limb project is expected to commence this summer, which is roughly 30km away from the Borden project. The stock has pulled back after a nice run and could be a good entry level.

Brazil Resources (BRI.V) – Brazil Resources has been fairly quiet lately. The only noteworthy news is the sending of documents to Brazil’s Department of Mining Production, in support of maintaining its mining license at the Cachoeira project. We expect management is working hard behind the scenes to create shareholder value. Warrants (BRI.wt) have begun trading, which have an exercise price of 75 cents and are good until December 31, 2018.

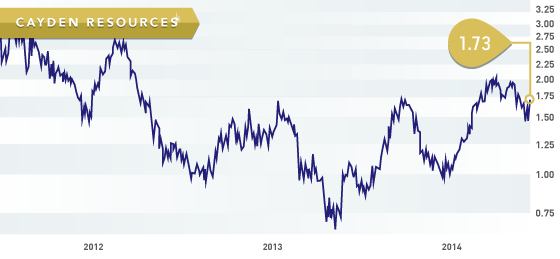

Symbol: CYD.T

Price: $1.73

Shares Outstanding: 47,425,790

Market Cap: $82,047,000

Cash: $10 million

This week, we feature Cayden Resources as stock of the week. Cayden is a gold exploration company exploring in Mexico. Their management and board have a proven track record and are targeting a multi million ounce gold discovery. Cayden has been on our radar for a while now.

Cayden’s feature property is the EL Barqueno project, which is 464 square kilometres with excellent infrastructure and accessibility. Management has indentified 9 exploration targets on the property and plans an aggressive work program this year. Drill assays released this week from the Pena de Oro target on the property included 54m of 1.36g/t gold and .52% copper.

Another iron in the fire is the Morelos Sur project, with the La Magenetita target and the Las Calles land position. We expect a sale of Las Calles land position to Goldcorp in late 2014/2015.

The bottom line is in an extremely weak market for exploration companies, Cayden is best of breed. It fits everything investors should be looking for in an exploration company:

- A healthy treasury ($10 million)

- Excellent share structure (47 million shares outstanding)

- A proven experienced management team

- Drill assays that show potential for an economic and sizeable deposit

JUN