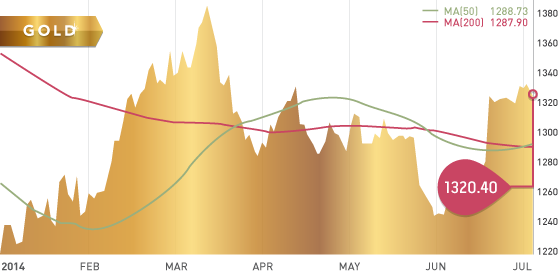

Another week with no substantial move in gold. Gold closed the week at 1320.40, up $3.12 from last week’s close of 1317.18. Stronger than expected US job numbers show the unemployment rate at 6.1%, which would be a six-year low, and has the gold bears out in full force. If you have confidence in the US data, the economy is recovering, which would be bearish for gold. Gold bulls will be looking at the budget details coming from the Indian government next week. The government has indicated that they will lower the import restrictions on gold. This would be extremely bullish for the physical market, as India is the second largest global consumer of gold.

Technicals:

- 50-day moving average: $1288.73

- 200-day moving average: $1287.90

Silver

Another green week for silver, making it five positive weeks in a row. An interesting article on how silver warehouse stocks have declined 82% in the past 15 months can be found here.

Platinum

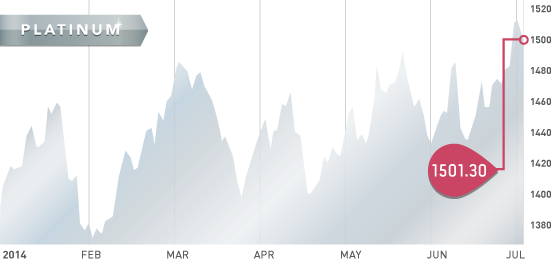

The price of platinum closed above $1,500 an ounce this week. We think more upside potential is ahead within the next several months. The mines will take months to ramp up, and the costs of restarting production will put added stress on the balance sheet of producers. Our favourite stock is Stillwater Mining (SWC), who is an American producer with a strong balance sheet.

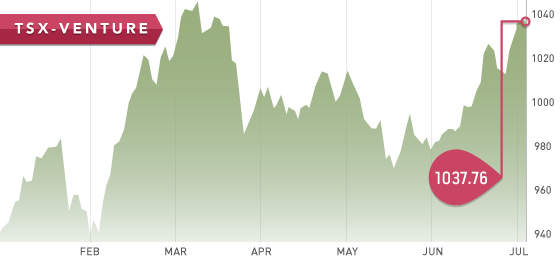

The TSX Venture continues to surprise us and finished at 1037.76. Overall, the TSX Venture is now up 10.49% year to date, which is kind of surprising given the sentiment in Downtown Vancouver. John Kaiser wrote an interesting piece on his thoughts, and we recommend you give it a read if you are interested in the junior sector. The article can be found here.

A Look Ahead

- The key items on the calendar this week are:

- Tuesday – July 8th – Consumer Credit

- Wednesday – July 9th – FOMC minutes

- Thursday – July 10th – Unemployment Claims

- Friday – July 11th – Treasury Budget

Quite a few of these companies are facing tough times, as they have a hard time creating shareholder value with low cash.

BC development companies will be sent out next week.

A new top 10 report on stocks to watch will be issued sometime in mid August to early September. We are looking forward to researching this topic and we have confidence that a few big winners will be covered.

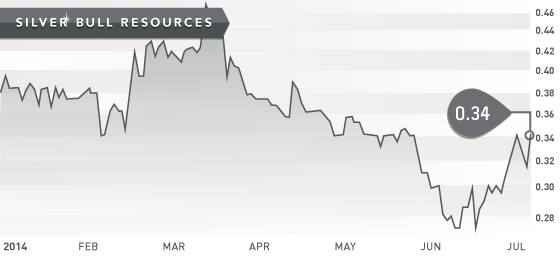

- Symbol: SBV.V

- Price: $0.34

- Shares Outstanding: 159,072,657

- Market Cap: $50,108,000

- Cash position: $3.095 million (April 30,2014)

This week, we take a look at a Mexican silver company in the development stage, Silver Bull Resources. We feel that Silver Bull is a potential takeover candidate for Couer D’Alene (CDE: NYSE), which owns 10.9% of the outstanding shares. The Sierra Mojada project has an IRR of 23.1%, at $23.50 per ounce silver and 95 cents per pound zinc. A fairly low CAPEX of $297.2 million makes this an attractive takeover to a major. Management plans on moving the project forward to production by obtaining the necessary permits. A key permit needed is the issuance of Surface Title Rights, as the project is on federal land.

The Sierra Mojada project contains 163.6 million ounces of silver and 2.2 billion pounds of Zinc. The revenue split is projected to be 28% zinc and 72% silver. Zinc is a metal that we expect to follow closely, as it is forecasted to go into a supply deficit in the next few years. This week, zinc closed at a 3 year high, at above $1/lb.

The bottom line is that at higher metals prices, this will be an extremely profitable project. Majors will be hungry to acquire these types of deposits to replace reserves.

JUL