*Note: There will be no charts for gold, silver or platinum this week. Our usual source for this information was down.

A quiet week for gold, finishing the week at $1,307.70 per ounce. The price of gold closed at a five week low, and this marks two consecutive down weeks. Gold bears point to an improving US economy, with better than expected US durable orders for June released this week. US equities continue to hit record highs.

The China Gold Association reported a 19% drop in gold demand from January to June. This is considerable, but quite a few analysts have a hard time believing any numbers that come from China.

Gold bulls continue to point towards geopolitical tensions that will underpin the gold price. Indian gold demand will pick up in the months ahead, especially September and October.

Lots of economic data out next week, including the FOMC rate, unemployment data, and GDP numbers.

Technicals:

- Support: $1278

- Resistance: $1325.90

Silver

Silver closed the week at $20.75 per ounce. Silver continues to trade in a fairly tight range and in the last year is up 2.2%.

Technicals:

- Support: $20.00

- Resistance: $21.21

Platinum

Platinum closed the week at $1,474 per ounce. The sister metal of palladium is at record highs and talk has started about substituting palladium for platinum in catalytic converters if this price trend continues.

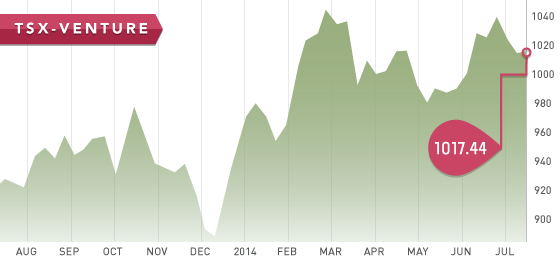

The TSX venture was fairly quiet this week, finishing at 1017.44, up 5 points. We are in the summer doldrums, and continue to be selective and look for higher quality names heading into the fall. Stay away from any junior resource company with a low cash balance (<$500,000), as we see these companies delisting in the next 6-12 months.

A Look Ahead

The key items on the calendar this week are:

- Monday July 28– Pending Home Sales

- Tuesday July 29- Consumer Confidence

- Wednesday July 30- GDP Advanced (Q2)

- Wednesday July 30- FOMC rate decision

- Thursday July 31- Employment data

- Thursday July 31- Chicago PMI

- Friday August 1- Unemployment rate

- Friday August 1- Auto sales

Ontario development companies were sent out earlier this week.

Next up are Mexico companies, which are in the designers queue.

The top 10 stocks for 2014 results are below:

| Overall return (10 stocks) | Top 5 |

| 45.03% | 67.40% |

| Company | Symbol | Jan 2014 price | July 25 price | Return |

| Rubicon | RMX.T | $0.92 | $1.61 | 75.00% |

| Timmins | TMM.T | $1.23 | $2.06 | 67.48% |

| USA Silver | USA.T | $0.35 | $0.59 | 68.57% |

| Royal Gold | RGL.T | $84.11 | $84.30 | 61.46% |

| B2Gold | BTO.T | $2.31 | $3.01 | 30.30% |

| Tahoe Resources | THO.T | $17.66 | $29.05 | 64.50% |

| Rio Alto Mining | RIO.T | $1.75 | $2.60 | 48.57% |

| Excellon | EXN.T | $1.14 | $1.36 | 19.30% |

| Orca Gold | ORG.V | $0.41 | $0.63 | 53.66% |

| Bayfield Ventures | BYV.V | $0.35 | $0.215 | -38.57% |

This week, I was busy at the Sprott Natural Resource Symposium, here in Vancouver, B.C. I was busy taking in presentations and talking to companies in advance of our next Top 10 report.

Instead of our normal stock of the week, I will mention several companies that stood out and a little bit about them. Some of these companies below will be covered in depth in our “Top Stocks to Watch: Fall 2014”.

Altius Minerals – ALS.T $14.70 – Altius is royalty company that is trading at a very cheap valuation. I took in the company presentation, and Altius will collect roughly $30 million in revenue in 2014. A big acquisition of Prairie Mines earlier this year was a game changer for ALS shareholders. If you buy this one and tuck it away for the next several years, you will do very well.

Eurasian Minerals (EMX.T)$0.83 – Eurasian is putting a new spin on the prospect generator model calling themselves “the royalty generator.” EMX has some of the top technical talent (brains) in the world, according to Rick Rule. One property is currently paying EMX roughly $3-$4 million a year at current gold prices. Shareholders include Sprott, Rick Rule, Brent Cook, and Adrian Day.

*Disclosure: I (James Fraser) own shares in EMX, purchased in the open market and therefore I am biased. As always, do your own due diligence and make your own investment decisions.

Cayden Resources (CYD.T) $2.38 – We covered Cayden several weeks ago in our Weekly Trends e-mail. At the show, we listened to a company presentation and talked to company executives. Cayden is on to a major gold district sized discovery and is 3 for 3 in drilling targets so far. Look for lots of news flow from Cayden in the next several months.

Roxgold (ROX.V) $0.88 – Roxgold has the highest grade undeveloped gold project in the world, greater than 1 million ounces. Management is in the process of securing debt financing and hopes to start construction late in Q4 this year. Construction will take1 year and this will be an extremely profitable mine when it comes online.

Ivanhoe (IVN.T) $1.54- I was excited to take in the talk by Robert Friedland: Mega Wealth Through Mega Discoveries. Mr. Friedland told a compelling story on the demand for copper and platinum in the next several years. He then went on to discuss his 3 major projects and how they will help fill the void. I feel that IVN is a great long-term position for any portfolio.

Next week several major gold producers release earnings including Agnico Eagle, Yamana, Goldcorp, and Detour Gold.

JUL