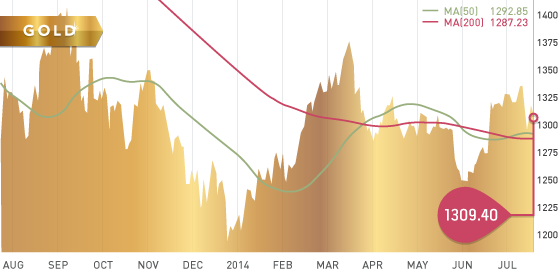

A volatile week for gold, finishing the week at $1,309.40 per ounce. Gold fell sharply on Monday, as it started the week on a large sell order and profit taking, ahead of Janet Yellen’s testimony on Tuesday. Thursday saw a quick spike due to the news of a Malaysian plane being shot down. Gold bears continue to point to a lower gold price, as the US economy recovers and will raise interest rates. The geopolitical situation continues to underpin the gold market as we wait for buying season to commence from India. Economic data next week is fairly light, so I would expect gold to remain range bound.

Technicals:

- 50-day moving average: $1292.85

- 200-day moving average: $1287.23

- Support: $1292.60

- Resistance: $1346.80

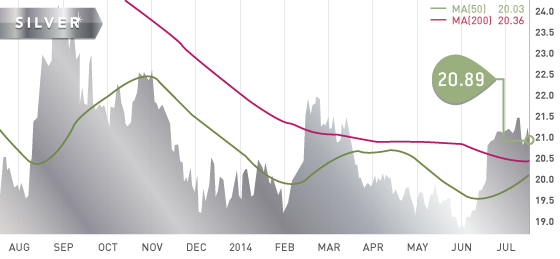

Silver

Silver closed the week at $20.89 per ounce. The London Silver Fix ends on August 15th, and we will see if it has any effect on the silver market.

Technicals:

- 50-day moving average: $20.81

- 200-day moving average: $20.36

- Support: $20.70

- Resistance: $21.67

Platinum

Platinum closed the week at $1,489.90. The world’s largest platinum producer, Anglo American, released its production report for the 2nd quarter, ahead of financials due out July 25th. As a result of the strikes, platinum output dropped to 358,000 ounces in the quarter, which translates to a 40% drop. Implats announced that production has been halved at its largest mine in Zimbabwe, following a major collapse underground.

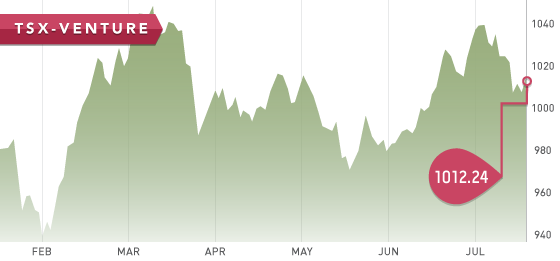

The TSX venture sold off a little this week, finishing at 1012.14, as gold and oil dropped in price. The exchange did manage to stay above the 1000 level. As I go through our Tickerscores updates, I continue to see weak fundamentals for many junior mining companies. I still expect a couple hundred companies to delist in the next 6-9 months, which will be good for the sector.

A Look Ahead

The key items on the calendar this week are:

- Tuesday July 22– Consumer Price Index

- Tuesday July 22- Existing Home Sales

- Thursday July 24 – Employment Claims

- Thursday July 24 – New Home Sales

Ontario exploration companies were sent out earlier this week.

The next region is Mexico, which is almost done and will be followed by Nevada companies. As always, if you would like an update on any company, please email info@tickerscores.com.

A quick note on June 28th’s Stock of the Week, Gainey Capital (GNC.V). At the time, it was 41.5 cents and closed this week at 54 cents. Not a bad gain so far.

- Symbol: IVN.T

- Price: $1.47

- Shares Outstanding: 691,717,674

- Market Cap: $1,030,659,000

This week, we take a look at Robert Friedland’s Ivanhoe Mines. Ivanhoe has three world-class projects that are well into the development stage. The projects all feature high grade mineralization, but are located in politically risky jurisdictions. Mr. Friedland is one of the most successful mining entrepreneurs in the last twenty years and owns 23.8% of the stock.

The signature project would be the Platreef project in South Africa. Ivanhoe will end up owning 64% of this project. A PEA was released in March 2014, showing an after tax IRR of 14.3%. The base case annual production would be 785,000 ounces of platinum, palladium, rhodium, and gold. A mining right was obtained from the South African government at the end of May, which will be valid for up to 30 years.

The Kamoa project is located in the Democratic Republic of the Congo. The project is the world’s largest undeveloped high-grade copper deposit. A resource estimate in January 2013 indicated reserves of 43.5 billion pounds of copper, at 2.67%. In November 2013, a PEA showed an after tax return of 15.2%

The third project is the Kipushi project, also in the Democratic Republic of the Congo. Drill results from the Kipushi project caught my eye this week, with a headline intercept of 339.4m of 44.8% zinc. This zinc grade is phenomenal and as mentioned before, we expect the zinc market to heat up over the next 12 months. This is a past producer, which was mined between 1924 and 1993, and IVN is now dewatering the mine.

Bottom line, if you are a contrarian investor who wants to own three world-class projects, led by a legendary mining entrepreneur, IVN is the stock for you. If you tuck Ivanhoe stock away for a few years, you could easily see a 5 to 10 bagger.

As you can see from the chart, investors have a chance to buy IVN near all time lows at these levels.

JUL