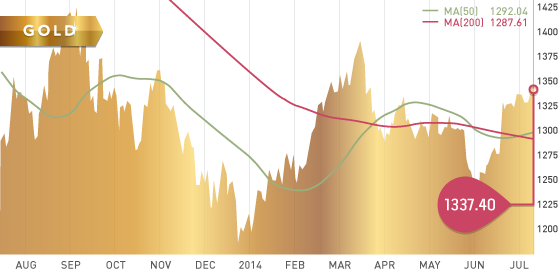

A positive week for gold, as the yellow metal hit four-month highs, closing at $1,337.40. Gold is now up approximately 11% percent in 2014, after losing 28% in 2013. This week is the sixth consecutive weekly gain for gold, as a slow and steady rise is keeping the bulls happy. Gold rallied following the FOMC minutes on Wednesday, which stated QE will likely wrap up in October.

The Indian government has not yet changed gold import laws. In last week’s Weekly Trends, we mentioned that if the laws changed, it would be bullish for gold. We are nearing in on India’s yearly gold buying peak, as the autumn wedding/festival season is on the horizon. Another factor in the gold market continues to be the geopolitical situations, which do not seem to be improving.

Technicals:

- 50-day moving average: $1292.04

- 200-day moving average: $1287.61

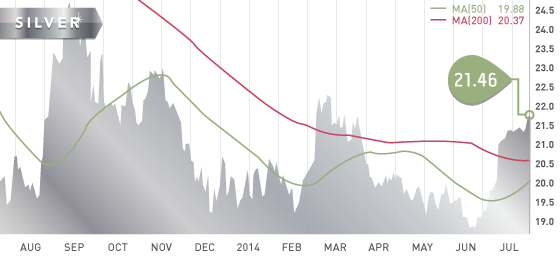

Silver

Silver has had a substantial move, from the $18.80 level of early June, to closing at $21.46 this week. This will provide a big boost to silver producers, as quite a few were near breakeven prices, at $20 silver. One of the best ways to play a rise in the silver market would be Silver Wheaton (SLW.T).

Technicals:

- 50-day moving average: $19.88

- 200-day moving average: $20.37

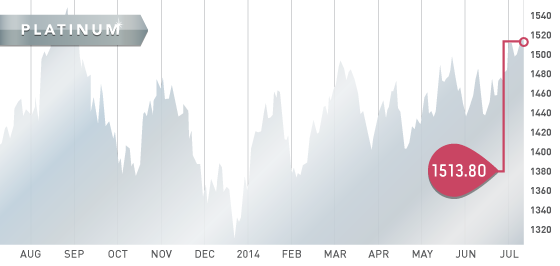

Platinum

Platinum closed the week at $1,513.80, almost the highest level in a year. The world’s largest platinum miners are still deciding whether to sell, or to shut down some of the mines affected by the strike. Platinum miners in Zimbabwe are asking for a reduction in levies, claiming it will collapse the industry if left unattended. This will be something to keep an eye on, as Zimbabwe produces roughly 400,000 ounces of platinum a year.

We are in the dog days of summer for the TSX Venture, and it is fairly quiet overall. The volume has dried up, as it usually does in the summer, with not one day this week exceeding 60 million shares traded. Overall on the week, the exchange was down 14.83 points from the previous week.

A Look Ahead

The key items on the calendar this week are:

- Tuesday July 15 – Retail Sales

- Wednesday July 16 – PPI

- Thursday July 17 – Employment Claims

- Thursday July 17th – Housing Starts

- Friday July 18th – Leading Indicators

Ontario exploration and development companies have been scored and are in the queue for our graphic designers.

A quick update on the top 10 stocks selected at the beginning of 2014: The overall return of the Top 10 year to date is very good, at 46.68%, with the top 5 up 65.41%. Try finding that performance anywhere else!

Stock updates

This week, we will update several of the previous stock of the weeks.

Lake Shore Gold (LSG.T) – We first featured LSG at $0.88 cents on April, as a good bet on a gold producer that is making money. Lake Shore released news this week of an excellent quarter, producing 52,300 ounces of gold. Free cash flow is very strong, with all in sustaining costs of $810 (USD) per ounce in Q2. Lake Shore stock has responded, closing at $1.28 on Friday.

Garibaldi – (GGI.V) – Garibaldi was featured as one of our exploration stocks in our “Top 10 Stocks to Watch This Summer.” At the time of the report, the stock was selling for 17 cents; it is now 30, which is approaching a double. Garibaldi hit an excellent high-grade silver hole in Mexico. Follow up drilling is in progress and they have put the BC projects on the backburner for now.

Roxgold (ROG.V) – Roxgold was our stock of the week at the end of April. It is one of the highest grade undeveloped gold project in the world, at 15 g/t. The second half of the year will see permitting, financing, and exploration /development work. The stock is up from 67 cents to 84 cents.

Detour Gold (DGC.T) – Detour continues to ramp up towards full production at the large Detour Lake mine, in north-eastern Ontario. We still think that Goldcorp has to be looking at Detour, after losing out on Osisko. May 3rd was when we featured Detour at $11.86, it is now trading at $14.35 a share.

Marlin Gold (MLN.V) – Marlin is working on achieving commercial production at the La Trinidad mine in Mexico. The streaming and equity deal was closed this week with Golden Reign (GRR.V). Marlin’s stock trades low volume, but we remain bullish on this name going into the second half of 2014.

Premier Gold (PG.T) – Premier has excellent projects in two of the best mining jurisdictions in the world, Ontario and Nevada. The stock has had a significant move lately, after an updated 43-101 showed an increase of indicated resources at the Hardrock deposit (to 4.87 million ounces). We looked at Premier on April 5th at $2.05 a share and it is now up over 50% to $3.35.

Cayden (CYD.T) – A big move in Cayden shares this week, closing at $2.40, as the market might be waking up to the story developing here. We took a look at Cayden just 3 weeks ago, after following them for the past 12 months. As we mentioned, Cayden ticks all the boxes you want in an exploration company – financial, management, and project potential.

Timmins Gold (TMM.T) – On May 25th, we mentioned Timmins as a go to name in the gold space. At the time, TMM was trading at $1.45 and is now at $1.99. We continue to favour small producers, like Timmins. Timmins remains cheap, compared to its peers in Mexico on several metrics.

JUL