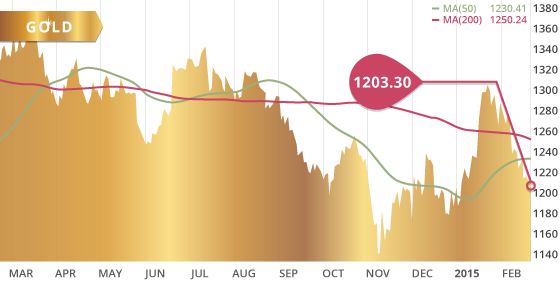

Gold

Last week gold continued its retreat and reached a 6-week low in the process. Gold closed Friday’s session at $1203.30, down $24.60, or 2% on the week. The metal fell through multiple levels of support including a 6 ½-week supporting trend line in place from the low of January 2nd. There remains a stronger support line in place from the November low that currently sits around the $1183 level, which should provide significant support. However, a break below this level would be extremely bearish for the metal. As the markets are still waiting for a definitive rate-hike direction from the FOMC, gold will be extremely sensitive to the testimony by Janet Yellen this week. This testimony in combination with the economic data out of the U.S., will most likely set the course for gold over the next few weeks leading up to the FOMC meeting in March. Last week gold found buyers at the $1197 level on Wednesday and Friday, which coincides with a final retracement mark of the run-up from the low of November 7th to the high reached on January 22nd. This level marks a significant correction from the January highs and provides near-term support, however, as mentioned above the $1183 level is solid support.

Technicals:

- Support: $1182.70

- Resistance: $1,225.25

- 50 day moving average: $1,230.41

- 200 day moving average: $1,250.24

- HUI/Gold Ratio: 0.153 (Last week 0.156)

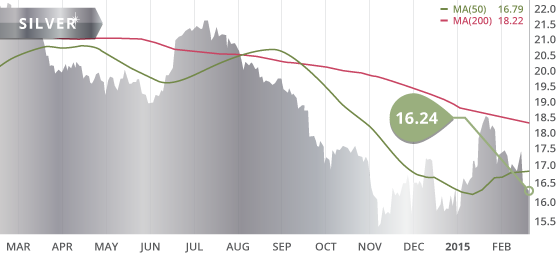

Silver

Silver fell hard on Monday, closing below the 50 day MA for the first time since early January. The metal continued its downward momentum for the rest of the week, finally ending Friday’s session at $16.24, down $1.08 or 6.2% on the week. There is near-term resistance at $16.80 and also at the $17.05 level. Solid support comes in at the $15.50 level, although there is a broken trend line in place that may offer support around the $15.90 level. As with gold, the testimony by Yellen coupled with the sensitive economic data out of the U.S., will most certainly set the course for silver over the next few weeks as well.

Technicals:

- Support: $15.51

- Resistance: $16.80

- 50 day moving average: $16.79

- 200 day moving average: $18.22

- Gold/Silver Ratio: 74.09

- XAU/Gold Ratio: 0.0617 (Last Week: 0.0628)

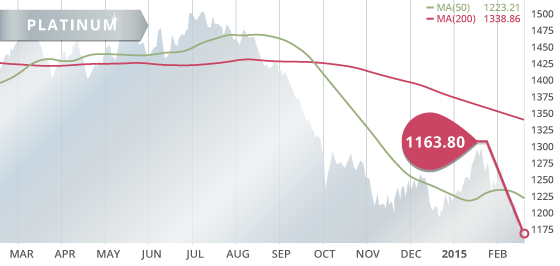

Platinum

Platinum collapsed this past week with sellers pushing the metal to a fresh new multi-year low. In the process, the metal reached its largest discount to gold in nearly two years. Many factors are contributing to platinum’s decline, including: a slowing global growth outlook, an increasing platinum recycling growth rate, increasing electric vehicle usage, and a declining outlook for diesel engine usage. This scenario is very bearish for the metal, and in regards to platinum price technicals, a drop below $1100 is looking likely for the metal. A descending moving average coupled with a retracement mark both provide solid resistance around the $1223 level. However, near-term resistance comes in around the $1180 level.

Technicals:

- Support: $1,076.08

- Resistance: $1,184.90

- 50 day moving average: $1,223.21

- 200 day moving average: $1,338.86

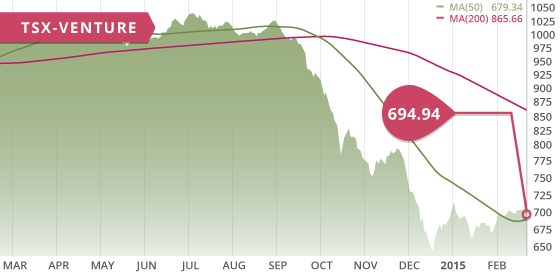

The TSX was down slightly on the week despite putting in a fresh five-month high on Monday. The TSX closed Friday’s session down 92.57 points on the week. The TSX-V was virtually flat on the week, ending Friday’s session down a mere 1.57 points to close the week at 694.94. The Venture remains above the 50 day MA despite a weaker metal prices environment.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday Feb. 23

– Ifo Business Climate Index (GER) – Consensus: 107.7

– Existing Home Sales (US) – Consensus: 4.97M

Tuesday Feb. 24

– GDP Growth Rate QoQ (GER) – Consensus: 0.7%

– CPI MoM, YoY (EA) – Consensus: -1.6%, -0.6%

– ECB President Draghi Speech (EA)

– CB Consumer Confidence (US) – Consensus: 99.6

– Services PMI (US) – Consensus: 54.0

– Fed Chair Yellen Testimony (US)

– BoC Govenor Poloz Speech (CAN)

Wednesday Feb. 25

– HSBC Manufacturing PMI (CHN) – Consensus: 49.5

– Fed Chair Yellen Testimony (US)

– New Home Sales (US) – Consensus: 475K

– ECB President Draghi Speech (EA)

Thursday Feb. 26

– Unemployment Change (GER) – Consensus: -10K

– Core CPI MoM, YoY (US) – Consensus: 0.1%, 1.6%

– Core Durable Goods Orders MoM (US) – Consensus: 0.5%

– Initial Jobless Claims (US) – Consensus: 285K

– Core CPI MoM, YoY (CAN) – Consensus: 0.1%, 2.1%

Friday Feb. 27

– GDP Growth Rate Q4 QoQ (US) – Consensus: 2.1%

– MI Consumer Sentiment (US) – Consensus: 94.0

– Pending Home Sales MoM (US) – Consensus: 1.8%

This is a busy week ahead with numerous market sensitive events and economic data due out. Tuesday and Wednesday will most certainly be volatile days where the markets will be closely scrutinizing the commentary of the Fed’s Yellen, the ECB’s Draghi, and even the BoC’s Poloz (Poloz on Tuesday). Both Yellen and Draghi speak twice this week, once on Tuesday and again on Wednesday. The precious metals will be very sensitive to the remarks of Yellen, as her commentary will indicate the proximity of rate hikes. Any indication one way or another will in turn set the course for the precious metals over the next few weeks leading up to the FOMC meeting in March, when markets will get their next spoonful from the Fed.

Last Week: The release of the FOMC minutes from their January’s meeting showed the committee having concern with some of the weak US data leading up to the January meeting, as well as concern with weakness in the global economy. The markets eventually shrugged the minutes off, as the meeting is over 3 weeks old now, and much of the data out of the U.S. has been stronger since then. On Friday Greece and the Euro Zone reached an agreement to a four-month bailout extension. This removed any of the Greek risk priced into the gold price, although the can has only been kicked down the road.

Mexico developers update is nearing completion and we hope to have it out at the end of the week or early next week.

Top 10 Updates:

Galane Gold (GG.V) announced this week that they have received the mining licence for their Tekwane Project. Mining is expected to commence in Q2 and be completed by the end of the year. The company also announced the start of construction of a gravity plant, which will be completed in June. Both of these events will increase production in the second half of 2015.

SilverCrest Mines (SVL.TO) announced the initial results from the exploration drilling at the El Duranzo target within their Ermitano property. Nine near-surface holes were drilled with the final hole being the best of the bunch. Hole ED-14-009 returned 0.59 g/t of gold and 2.5 g/t of silver over 25 meters. The intercepts are low grade but are oxidized and would be amenable to low-cost heap leach processing. The company has budgeted $2.3 million in 2015 to advance exploration at the Ermitano (I and II) concessions, as well as the recently acquired Cumobabi concessions.

Bear Creek Mining (BCM.V) announced an update to their feasibility study progress. The FS is expected to be released by the end of the first quarter and includes numerous optimized and updated parameters that are expected to significantly improve upon the economics displayed in the 2011 FS.

- Symbol: CSQ.V

- Price: $0.12

- Shares Outstanding: 129,315,095

- Market Cap: $15,517,811

- Cash: $2.9 million (As of Oct. 3rd)

- Significant shareholders: Gold Resources Corp. (17.2%), Hecla Mining Co. (13.3%), Management & Board (4.7%)

Note: Canamex was ranked #2 in Tickerscores Nevada Explorers category. The company also generated the best project score of their Nevada Explorer peers.

Canamex (CSQ.V) is an exploration company advancing the Bruner Project located in central Nevada. The company has the exclusive right and option to acquire 75% interest in the project, of which the company has completed $4.5 million of the $6 million in expenditures required to earn a 70% interest. The additional 5% can be earned by producing a bankable feasibility study. The project is situated within a 45-mile radius of three mines that have collectively produced over 15 million ounces of gold. Historic production at Bruner includes close to 100,000 ounces at a grade of 19.2 g/t of gold. The project contains an historic non-compliant resource, although the company is currently completing a maiden 43-101 compliant resource estimate, which is expected to be released at some point in the first quarter of 2015.

The company is in a stable cash position with over $2 million and no debt. Backing the company is two prominent mining companies, Hecla Mining Co. and Gold Resources Corp. Collectively, they hold roughly 30% of the shares. The CEO, President, and a director of Canamex, as well as Hecla, were all involved in the most recent financing that closed in October. It is always a positive to see management and major investors continuing to align themselves with shareholders.

Canamex has achieved some of the best drill results in Nevada since the company began drilling the Bruner property in 2012. Highlights from the past 3 years of drilling include hole B-1201 returning 110 meters of 4.08 g/t of gold, hole B-1301 returning 91 meters of 3.1 g/t of gold, and hole B-1436 returning 9.1 meters of 11.9 g/t of gold. The mineralization is near surface and initial metallurgical tests have resulted in encouraging recoveries. The placement and orientation of the mineralization within the topography of the property indicates the deposit would provide a low strip ratio, which would help support the economics of the project.

Bottom line

This is an early stage exploration company that will soon define their progress at Bruner with an initial resource estimate due out in the coming weeks. The maiden resource will help the market rerate the company, which may prove to provide a significant appreciation to the current price of $0.12 per share. The company is in a stable financial position with over $2 million in cash and no debt. The high share count is a bit of a concern, and should be considered if investing in the company. However, as mentioned before, a positive resource estimate should generate an increase in the share price off of these levels. With Hecla electing to increase its position in Canamex during the most recent financing, it is evident the Bruner Project remains attractive to the major.

Potential Catalysts and Events to Monitor:

- Maiden Resource Estimate (Q1 2015)

- Bruner Follow-up Drilling (2015)

FEB