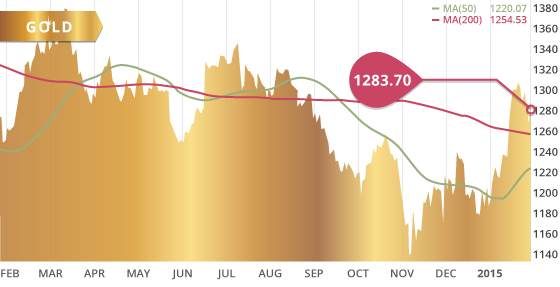

Gold was down $10.40 on the week after experiencing a volatile two days of trading on Thursday and Friday. After plunging $30 on Thursday, the metal found support at the 200 day MA which was also a support level of a retracement mark of the strong move up in January. We are currently in a cluster of trend lines and retracement marks that gold will need to break out from. A strong break above the $1300 level would be a good sign that buyers are in control and that the metal is headed higher.

The plunge on Thursday came the day after the FOMC maintained their current benchmark interest rate. Contrary to market expectations of a rate hike getting pushed back to late 2015 or early 2016, the FOMC statement indicated they remain confident in the expansion of the U.S. economy and showed little concern about the impacts from a stronger dollar and the growing global growth concerns. This confidence displayed by the FOMC changed investors’ expectations back to rate hike expectations for as early as June. This brought sellers into the gold market and easily pushed the price down $30. However, with the global economy still a concerns for investors, buyers came in to support the price on Friday, pushing the metal back up $30.

Technicals:

- Support: $1252.00

- Resistance: $1,309.71

- 50 day moving average: $1,220.07

- 200 day moving average: $1,254.53

- HUI/Gold Ratio: 0.157 (Last week 0.152)

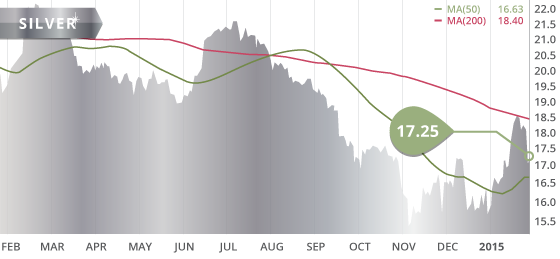

Silver

Largely as a result of Thursday’s plunge, silver closed the week at $17.25, down 5.9%. The metal continued to obey the 200 day moving average and bounced off of the trend line once again this week. There seems to be significant resistance at the $18.50 level, and silver will need to power through that level to show the up trend is still intact.

Technicals:

- Support: $16.65

- Resistance: $18.50

- 50 day moving average: $16.63

- 200 day moving average: $18.40

- Gold/Silver Ratio: 74.42

- XAU/Gold Ratio: 0.0618 (Last Week: 0.0605)

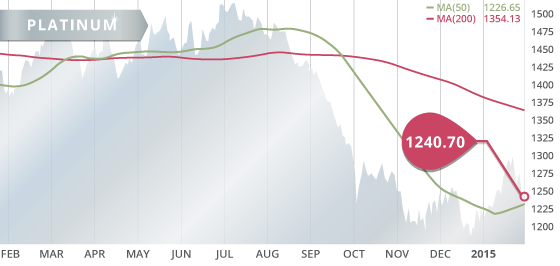

Platinum

With platinum also a victim of Thursday’s sell off, the metal ended the week at $1240.70, down $55.90 or 4.3%. With global growth projections continuing to weigh on the metal, the January price rally has been stifled and the metal is having a hard time finding support.

Technicals:

- Support: $1,184.50

- Resistance: $1,271.30

- 50 day moving average: $1,226.65

- 200 day moving average: $1,354.13

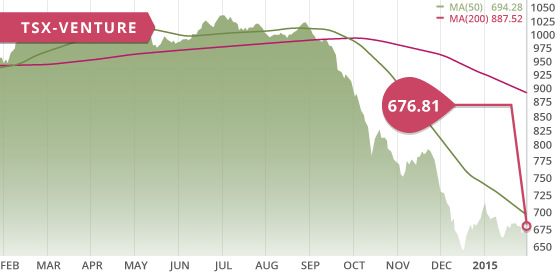

The TSX and the TSX-V were both down slightly on the week, with the TSX-V closing at 676.81, down a mere 1.37 points. Thanks to the strong rebound by gold on Friday, the gold sector was up 2.65% on the week. The base metals sector was also up 2% on the week as the copper price found support on Friday. The Canadian dollar dropped to a 6-year low on Friday after data showed Canadian GDP contracted in November as manufacturing dropped the most since 2009.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday Feb. 2

– GDP (RUS) – Forecast: 0.57%

– Personal Income, Spending (US) – Consensus: 0.2%, -0.2%

– ISM Manufacturing PMI (US) – Consensus: 54.5

– Construction Spending (US) – Consensus: 0.6%

Tuesday Feb. 3

– RBA Interest Rate Decision (AUS) – Consensus: 2.5%

Wednesday Feb. 4

– ADP Employment Change (US) – Consensus: 225K

– ISM Non-Manufacturing PMI (US) – Consensus: 56.2

– Ivey PMI s.a. (CAN) – Forecast: 54.96

Thursday Feb. 5

– Initial Jobless Claims (US) – Consensus: 290K

– Balance of Trade (US) – Consensus: -$38B

– Balance of Trade (CAN) – Consensus: -$1.1B

Friday Feb. 6

– Inflation Rate YoY (EA) – Consensus: -0.5%

– Employment Change (CAN) – Consensus: 4.5K

– Average Hourly Earnings (US) – Consensus: 0.3%

– Non Farm Payrolls (US) – Consensus: 230K

– Consumer Credit Change (US) – Consensus: $15B

This week the market will focus on the jobs numbers out of the U.S., as well as the consumer spending and manufacturing/non-manufacturing data. The markets will also be keeping a close eye on the rate decision by the RBA on Tuesday.

Last Week: In Greece last week, the Syriza party won the parliamentary elections, which has injected some level of uncertainty into the market regarding their debt repayments and their involvement in the Euro.

The FOMC rate decision showed that the Fed members are confident in the strength of the U.S. and reignited expectations of a rate hike as early as June. GDP in Canada shrank 0.2% in November, sending the loonie down to a six-year low. The inflation rate in the EA continued to decline and is showing further disinflationary pressures. Russia cut their benchmark interest rate to 15% after raising it to 17% in December.

Nevada developers will be released this week as we are now preparing an update on Mexico Developers, which we anticipate will be out in the second week of the month.

Top 10 2015 Updates:

Dalradian Resources DNA.TO announced this week that mining legend Ross Beaty made an C$11.3 million investment into the company by way of a non-brokered private placement. The company issued Mr. Beaty 12,556,000 shares representing 9.9% of the company.

Rockhaven Resources RK.V announced the completion of a maiden resource estimate for their flagship Klaza Project. Using a cut-off grade of 1.5 g/t Au, the inferred resource contains 1.3 million gold equivalent ounces at a grade of 5.79 g/t AuEq. The resource also includes 121 million pounds of lead, 144 million pounds of zinc, and 14 million pounds of copper. The combination of these three metals would also roughly add another 200,000 gold equivalent ounces to the total. 1.5 million gold equivalent ounces is a great start for the Rockhaven team. The 2015 drill program will help expand on this initial resource as well as improve the confident in the contained metal. At least 10,000 meters is planned for this year’s program, which should kick if sometime in late spring to early summer.

Montan Mining Corp. announced that they have received conditional approval from the TSX Venture Exchange for the proposed amalgamation of Montan Capital and Strait Minerals. The two companies will now seek approval from their shareholders at their shareholders meeting to be held February 24, 2015.

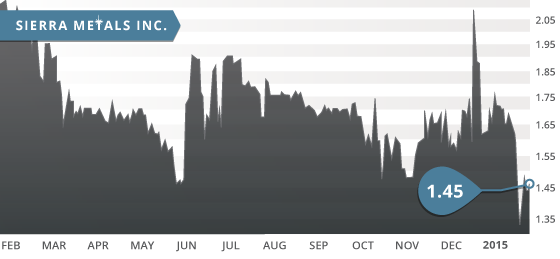

- Symbol: SMT.TO

- Price: $1.45

- Shares Outstanding: 159,642,009

- Market Cap: $231,480,913

- Cash: $46.5 million USD

- Significant shareholders: Arias Resources Capital (51%), Black Rock Inc (11%)

Sierra Metals (SMT.TO) is a silver producer with operations in Mexico and Peru. The company operates the Yauricocha mine located in the Lima Department of Peru, as well as the Bolivar and Cusi mines located in Chihuahua, Mexico. Last week the company released their fourth quarter and 2014 production results, as well as their 2015 guidance. The production in 2014 exceeded the company’s guidance for the year, with Q4 being the best performing quarter in the company’s history in terms of metal production and tonnage. As a result of improved performance at all three of its mines, the company has increased their 2015 guidance by as much as 10%-20%.

The flagship Yauricocha Mine is a high temperature carbonate replacement polymetallic deposit producing silver, lead, zinc, copper, and gold. This low-cost mine generates approximately 70% of the revenue for the company. On a by-product basis the cash cost are (-$26.41) per ounce of silver. In other words, this is like selling the silver for approximately $43.41 an ounce in the current $17 per silver price environment ($26.41 + $17).

The company is currently completing a two-year $36 million upgrade of the underground infrastructure of the mine, including the sinking of a new internal shaft from the 720 level down to the 1,220 level. A new 5.5 km tunnel that will connect to the internal shaft will be complete by mid-2015. These developments will allow the company to access deeper ore, as well as remove operational bottlenecks. Since acquiring the Yauricocha mine in 2011, the company has drilled over 80,000 meters expanding the reserves and resource of the deposit. A resource update is expected in the first quarter of 2015. Based on the current reserves, the mine has at least another 7 years of life. With the drilling completed since 2011, the company should have no problem expanding the mine life at Yauricocha, especially since similar mines in Peru extend to depths of 2 km.

The company has also been successful in increasing production at their Mexico operations while using cash flow to expand and develop the

Cusi and Bolivar mines. The current shaft development at Cusi is expected to be complete in Q2 on 2016, and will increase production capacity from the mine threefold.

The company is in a healthy financial position with US$47 million in cash as well as a US$60 million credit facility available ($15 million drawn down at this point). The company has $39 million in net debt, which is manageable with the company generating roughly $2 million in profits per quarter. The company also pay an annual dividend of 2 cents per share. The CEO and CFO have bought shares in the open market including a purchase as recently as last week. The CFO bought 16,500 shares on the 27th of January. The Chairman also owns 51% of the shares through his company Arias Resources Capital. Between Arias and institutional support, only 8% of the shares held by retail.

Bottom line

This is a well-diversified miner producing five metals from their three mines. The Yauricocha mine is an excellent asset with tremendous expansion potential. Between the three mines, the company is generating free cash flow, and has produced 4 cent per share in earnings during the first 9 months of 2014. The record production in Q4 is sure to add to those earnings. Looking forward with this company, it is clear that the capital spent on mine development and expansion, as well as the extensive drilling at their operations, will position this company well into the future.

Potential Catalysts and Events to Monitor:

- Q4 and Annual Financials

- Yauricocha Resource Update – Q1 2015

- Yauricocha Underground Development

- Debt Repayment

FEB