Gold

After an initial collapse to the $1142 level following the rejection of the Swiss gold referendum, gold went on a rampage finally peaking at a 1-month high of $1221.13. Much to the relief of gold proponents, this near $80 reversal quickly put the price back above $1200 and broke resistance levels in the process.Tempering the strong move on Monday was a series of data points released throughout the week, including the particularly striking jobs report out of the US Friday morning, which threw water on the heated gold price and brought it back down below $1200. Gold finished up $26.80 to close the week at $1192.60.

In a positive sign for gold, data out of India had the state of Gujarat importing a 41 month high 39.98 tonnes of gold in November. This is up 66% from October. The country, as a whole, imported an unconfirmed 109 tonnes in November, the third straight month of 100+ tonnes. Multiple factors may explain the rise, but the RBI providing conditional relief in gold import restrictions, a lower gold price, and large demand during the current wedding season, have all been supportive of the increased demand. With the RBI announcing an end to the 80/20 rule effective immediately, it will be interesting if the strong demand in India continues in December. India is now more relaxed with their gold import restrictions as they are less concerned with their current account deficit. This is because the lower oil price environment more then offsets any rise in gold imports into the country.

Technicals:

- Support: $1,186

- Resistance: $1,221

- 50 day moving average: $1,202.73

- 200 day moving average: $1,272.52

- HUI/Gold Ratio: 0.139 (Last week 0.140)

Silver

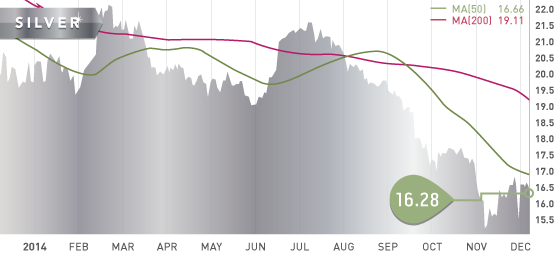

Silver was up 5.3% on the week to close at $16.28 an ounce. It spiked down with gold Monday morning to a fresh low of $14.00, but immediately rebounded 17.5% from that low to end the day at $16.46. Silver continues to bounce off a 5 month trend line, and is concurrently testing the 50 day moving average as well. A break above both would be a positive move for the metal, and would also coincide with a positive breach above of a retracement mark of potential resistance around the $16.90 level.

Technicals:

- Support: $15.40

- Resistance: $16.90

- 50 day moving average: $16.66

- 200 day moving average: $19.11

- Silver/Gold Ratio: 73.26

- XAU/Gold Ratio: 0.0588 (Last Week: 0.0587)

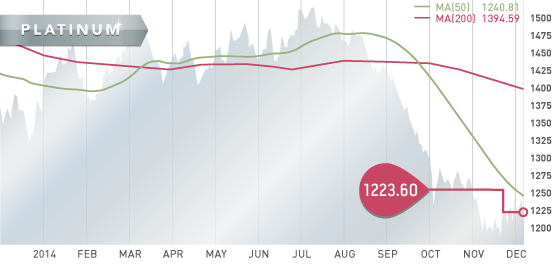

Platinum

Platinum spiked down early Monday morning along with both gold and silver, but also like the two aforementioned metals, platinum quickly rebounded $55 from the morning low to close at $1238.50. Platinum traded around that level for the rest of the week, closing at $1223.60, up 2% on the week. Platinum is testing the 50 day moving average, and although it briefly breached the indicator three times this week, it has not been able to close above the moving average since early August. A close above the moving average to end the week would also coincide with a break above a 2-month trend line. That outcome would have the metal then looking to test resistance around the $1260 level.

Technicals:

- Support: $1,181

- Resistance: $1,245

- 50 day moving average: $1,240.81

- 200 day moving average: $1,394.59

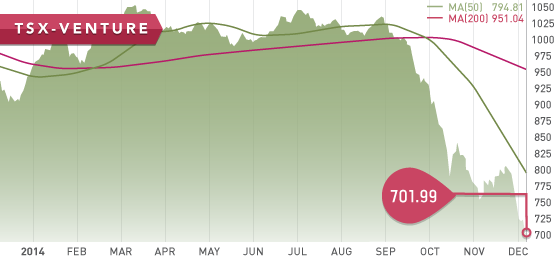

The TSX was down 271 points this week, after a 284 point drop on Thursday. This large decline was due to lower oil prices and disappointing earnings from TD Bank. The index closed the week down 1.8% to 14473.70, though should find support around the 14325 level.

The TSX-V continues to put in fresh new lows, declining nearly 40 points to close the week at 701.99. This 5.4% decline was largely attributed to the energy sector.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Sunday Dec. 7

– GDP Growth Rate Q0Q (JPN) – Consensus: -0.4%

Monday Dec. 8

– Balance of Trade (CHN) – Forecast: $44.6B

Wednesday Dec. 10

– Inflation Rate MoM,YoY (CHN) – Consensus: 0%, 1.6%

– Consumer Confidence (JPN)

Thursday Dec. 11

– Initial Jobless Cliams (US) – Forecast: 277K

– Retail Sale MoM,YoY (US) – Consensus: 0.3%, 4.24%

Friday Dec. 12

– Industrial Production (JPN) – Consensus: -1%

– Industrial Production (CHN) – Consensus: 7.5%

It is a fairly quiet week on the economic front, with the main items being from Japan and China. These items should help to give the market a sense of any positive impacts that recent stimulus measures from both countries are generating. The initial jobless claims out of the US will be watched after the blockbuster NFP was released on Friday. Also, November retail sales will be an item the market will be keeping an eye on, as Thanksgiving sales were down 11% in the US this year and consumer credit is showing signs of softening.

Last Week: As expected, the Swiss citizens rejected the gold initiative by an overwhelming 76% voting “no” on Sunday. In the Euro Area, the ECB lowered its economic growth forecasts, and stressed that risks remain to the “downside”. The ECB will be assessing monetary stimulus and expansion of the balance sheet early in 2015.

The BoC kept their overnight rate at 1% and indicated that the Canadian economy is showing signs of a broadening recovery. However, declining oil and commodity prices will weigh on the economy. In the case of lower oil, it will pose a downside risk to the recent rising of inflation in Canada. Also, as reports out on Friday indicated, a loss of jobs and slower exports may point to a weakening Canadian recovery.

PMI numbers out of the US were strong this week – especially the non-manufacturing PMI. ADP employment added 208K workers, below the consensus. In contrast though, the NFP out of the US on Friday were far above the consensus, in the range of 40% higher. The US added 314K jobs, the largest gain in nearly 3 years. The increase in consumer credit in the US was lower in October, which was the smallest increase since November of last year. A lot of data is indicating a strengthening recovery in the US, however inflation and wage growth remain a concern.

Mexico Gold Producers update was released this past week, with Timmins Gold taking the top spot. This week Mexico Silver Producers will be updated, with many of these companies seemingly undervalued compared to their net asset value. They are all finding it challenging with silver in the $16-$17 dollar level, especially after many expansion projects were initiated with silver around $30. These current levels will surely be seen as great buying opportunities when looking back in the future. Subsequent to Mexico Producers, Tickerscores will be updating both the Explorers and Developers of Nevada and Mexico.

The Tickerscores team continues to compile a short list of our Top 10 report, which we anticipate will be out near the end of December.

- Symbol: PZG.TO

- Price: $0.89

- Shares Outstanding: 161,547,969

- Market Cap: $143.8 million

- Cash: $4.9 million (As of Sept. 30)

- Significant shareholders: FCMI Financial Corp. (A. Friedberg) (15.2%), Van Eck (9.9%), Management and Directors (3.4%)

Note: Paramount was ranked 6th out of 17 development companies in Mexico. An update of Mexico developers is expected in two-three weeks.

We have chosen Paramount Gold & Silver Corp. (PZG.TO) as stock of the week as a result of a report out that Coeur Mining Inc. (CDE.NYSE) is in advance negotiations with Paramount in regards to their San Miguel Project in Mexico. Coeur has approximately $300 million in the treasury and is looking to expand their footprint in Mexico. However, under the apparent terms being negotiated, Paramount shareholders would be paid in Coeur shares, as well as hold shares in a spin off company which would hold Paramount’s non-Mexican assets.

This move would make sense for Coeur, as Paramount’s San Miguel Project consists of 40 concessions which encompass Coeur’s Palmarejo Mine. Therefore San Miguel represents near-term ore in the immediate vicinity of Palmarejo. The mine life at Palmarejo extends to 2021, however production begins to decline significantly in 2015, in the range of 35% when compared to 2014, and nearly 60% in 2016. With mine construction deferred at their La Preciosa Project earlier this year, Coeur will be looking at other accretive measures to sustain as well as increase their current production numbers. In this case, San Miguel represents a good solution to the looming production declines at Palmarejo. Speculation since the report came out Monday has pushed the share price up 17% this week. If a buyout does in fact occur we feel there is further upside to the share price beyond the 17% already priced in.

Projects

Paramount recently completed an updated PEA on the San Miguel Project, which displayed compelling economics. Using a base case gold price of $1350, the post-tax NPV5% of the project is estimated at $261.5 million, with an IRR of 15.9% and a payback in the third year of operation. These economics would be greatly improved should Coeur acquire the project. Much of the $70 million in initial capital would not be required since the ore extracted would be hauled to Coeur’s Palmarejo mill complex 5km away. San Miguel hosts a measured and indicated resource of 77.1 million ounces of silver and 1.1 million ounces of gold.

Paramount holds a number of properties in Nevada, specifically the past producing Sleeper Gold Project. 1.7 million ounces were produced from the open-pit mine during 1986-1996. Paramount completed a PEA on the project in 2012 which estimated a pre-tax NPV5% of $695 million, with an IRR of 26.8%. Sleeper contains a measured and indicated resource of 3.5 million ounces of gold and 40.6 million ounces of silver. In the inferred category the resource contains 5.4 million ounces of gold, and 61.1 million ounces of silver.

Bottom line

The company has approximately $5 million in cash, and has no debt. Regardless if the transaction between Paramount and Coeur actually happens or not, Paramount still is a company that holds two advanced stage assets with positive economics. The economics of the San Miguel Project are compelling on a stand alone basis, but even more so in a scenario where the $70 million initial CAPEX would not be necessary. This would make sense for Coeur, as they need mill feed for their Palmerejo mine with output dropping off dramatically after this year. This outcome would leave existing Paramount shareholders with shares in Coeur, as well as shares in a new spin-off company holding the Sleeper Project. The new spin-off company would be well funded to focus on Sleeper, as well as have a strong backer with Coeur.

Potential Catalysts and Events to Monitor:

- Potential Buyout

DEC