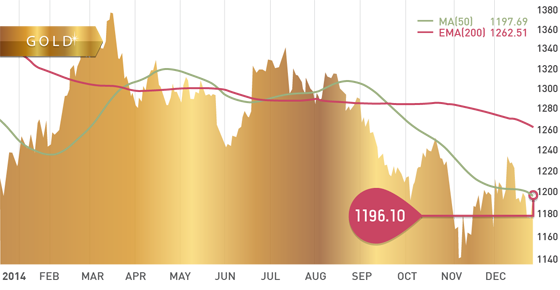

Gold was up slightly on the week at $1196.10 thanks to a strong push during the shortened session on Friday.

Frank Holmes, in his weekly roundup with US Global Investors, published an interesting note on gold. Even though it feels like gold has been going sideways all year, it is actually the second best performing currency on the year besides the US Dollar.

That said, in order for gold to finish in the black on the year as a whole, gold will have to close above $1204.80. That was gold’s close in 2013, which was its first yearly loss in 12 years. It will be interesting to see if gold can avoid its second annual decline during these last few days of 2014.

Reserves of the producers will be restated at the beginning of 2015, so investors should be able to see which companies have been high-grading during 2014 at the expense of their future reserves. Expect some degree of devaluation towards some of these miners, since the future economics of some of these deposits have been impacted by the high-grading decisions. As such, we are starting to see the impacts of lower metal prices at the project level. Some companies have been able to stay afloat at lower metal prices by increasing production and high-grading their deposits. This is a temporary solution to lower prices, but is not sustainable. These miners will either have to acquire new deposits to replenish their reserves, or hope for much higher gold prices to support the lower grade reserves that were created by high-grading. We should then begin to see an increase in acquisitions as miners attempt to replenish the decline in reserves with new accretive projects. There are some companies with attractive projects that have been heavily discounted. At these lower prices, these companies present excellent upside potential with a possible acquisitive environment on the horizon.

Technicals:

- Support: $1,170.70

- Resistance: $1,238.25

- 50 day moving average: $1,197.69

- 200 day moving average: $1,262.51

- HUI/Gold Ratio: 0.136 (Last week 0.138)

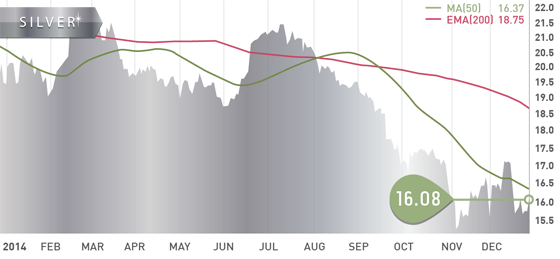

Silver

Silver closed the abbreviated week up a penny at $16.08. On low volume Friday, silver was able to make back the ground lost on Monday. The metal has found support around the $15.53 level at three separate occasions in the past 2 weeks. This seems to be solid short-term support, however, below that level we would be looking towards $15.00 once again.

Technicals:

- Support: $15.53

- Resistance: $17.80

- 50 day moving average: $16.37

- 200 day moving average: $18.75

- Silver/Gold Ratio: 74.38

- XAU/Gold Ratio: 0.0572 (Last Week: 0.0581)

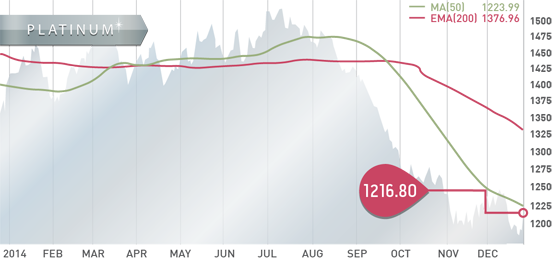

Platinum

Platinum finished the week up $20 thanks to a strong session on Friday which removed the losses incurred on Monday. Platinum actually put in a fresh new multi-year low of $1175.60 Monday, showing that sellers are still in control.

Technicals:

- Support: $1,175.60

- Resistance: $1,260.00

- 50 day moving average: $1,223.99

- 200 day moving average: $1,376.96

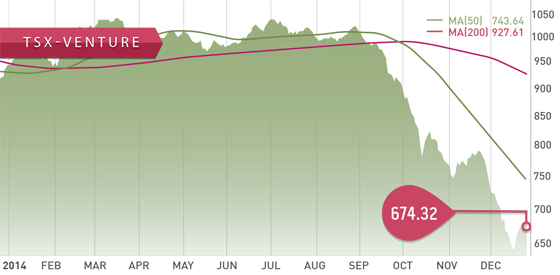

The TSX-V was down slightly during the abbreviated trading week to close at 674.32. The TSX continued its rally off its mid-December lows to close up 144.60 points or 1% on the week. Tax-loss selling is now over, and now the resource sector can hopefully look forward to some stability in the new year after experiencing substantial declines over the second half of 2014.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday Dec. 29

Tuesday Dec. 30

– Consumer Confidence (US) – Consensus: 93.0

– Case-Shiller Home Price YoY (US) – Consensus: 4.4%

Wednesday Dec. 31

– Manufacturing PMI (CHN) – Consensus: 49.5

– Initial Jobless Claims (US) – Consensus: 289K

– Pending Home Sales MoM (US) – Consensus: 0.5%

Thursday Jan. 1

– NBS Manufacturing PMI (CHN) – Forecast: 50.7

Friday Jan. 2

– Manufacturing PMI (CAN) – Forecast: 53.8

– Markit Manufacturing PMI (US) – Consensus: 53.7

– ISM Manufacturing Index (US) – Consensus: 57.7

It will be another somewhat quiet week as the most of the markets are still in holiday mode with New Years Day on Thursday. The main data points out this week will be the manufacturing PMI numbers out of the U.S., Canada, and China.

Last Week: The Christmas week was relatively quiet, except for the data points out of the U.S. on Tuesday and out of Japan on Thursday. Data out of the U.S. was mixed, with GDP growing by 5% in Q3, and consumer sentiment reaching an eight year high this month after data showed personal income and spending both rising in November. However, New Home Sales and Durable Goods Orders were both disappointing. The flurry of indicators released out of Japan on Thursday were also disappointing, and showed that the measures taken to spur economic growth are not working as hoped. In attempts to revive their economy, Japan’s cabinet approved $29 billion (US) in fresh stimulus on Saturday.

With our Top 10 selection for 2015 finalized, the Tickerscores team is now assembling the report, which we anticipate will be out shortly.

Silver Producers in Mexico will also be released early this week.

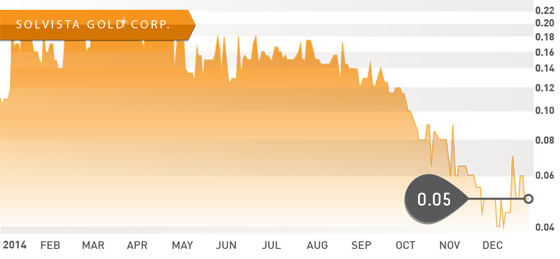

- Symbol: SVV.V

- Price: $0.05

- Shares Outstanding: 69,729,318

- Market Cap: $ 3.5 million

- Cash: $3.57 million (As of Sept. 30)

- Significant shareholders: Bullet Holding Corp (17%), Management and Directors (9%), Kinross (6%)

Note: Despite the high Tickerscore achieved by Solvista, the poor investment sentiment towards Colombia is a large reason for the low share price of the company.

Solvista Gold Corp. (SVV.V) is a gold exploration company exploring in Colombia. The company holds two promising projects in the province of Antioquia; the Guadalupe Project and their flagship Caramanta Project. In March of 2014, Solvista entered into an earn-in option agreement on their Caramanta Project with IAMGOLD (IMG.TO). Under the terms of the agreement IAMGOLD can earn up to 70% in the project by spending $18 million over 5 years to earn an initial 51%, and earn the additional 19% by incurring another $18 million over 3 years subsequent to the initial 51%. As part of the agreement IAMGOLD must complete a minimum non-discretionary $2.5 million in exploration expenditures. In August IAMGOLD commenced a 4000 meter drill program aimed at making new discoveries on the Caramanta property. We expect result from this program should be out early in the new year.

The Caramanta Project is host to a cluster of gold-copper-silver porphyries. Five drill targets have been identified so far, with drilling mostly concentrated on the El Reten zone. 4985 meters have been drilled at El Reten with highlights from the zone returning significant intercepts, such as drill hole CAD-12-18 which returned 1.01 g/t gold and 0.21% copper over 456.7 meters.

Bottom line

Solvista is in a stable financial position with $3.5 million in cash, and a conservative burn rate. At their current rate, they have enough cash to sustain themselves through 2015. Solvista has two promising exploration projects, one of which is being funded by a $36 million earn-in agreement by IAMGOLD. The earn-in agreement on the Caramanta Project enables Solvista to see their flagship project developed without having to raise money for drill programs in a difficult market. The scenario also provides the company with the benefit of having a strong technical and development team of a proven gold company manage the advancement of the project.

Colombia is not immune to political risk, as seen by the numerous measures taken by the government in attempts to reign in their mining industry. Despite these recent unsettling measures, it appears that Colombia is taking the steps to establish an industry standard framework to regulate the industry. However, it is just taking longer then investors currently have patience for. Regardless, we feel there are opportunities in the country such as Solvista, that are heavily discounted yet offer significant upside. These companies are subject to little downside now that it has essentially been removed over the past two years.

Potential Catalysts and Events to Monitor:

- Ongoing Caramanta Drilling (Commenced Q3 2014)

- Colombia Mining Reforms

DEC