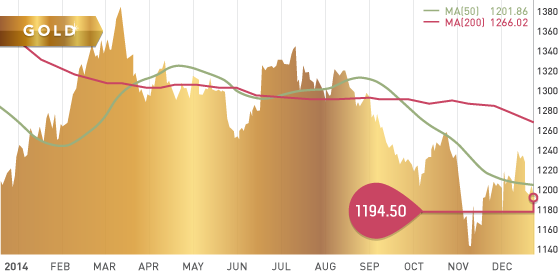

Gold started the week by wiping away all of the gains made the week prior, as investors poured back into the US dollar ahead of the FOMC meeting. Gold was down $30 on Monday, which essentially set the tone for the rest of the week. Upon the FOMC announcement gold fluctuated as the market digested Yellen’s commentary and eventually it trended lower as investors decided to flow into the dollar. Gold momentarily breached the $1186 level on Thursday, but without sustained selling it found support at the $1182 level and quickly bounced back above the $1210 mark. However, the strength was un-sustained and gold closed the week below $1200, at $1194.50, down $27.70, or 2.3%.

Russia continued to added another 18.7 tonnes to its gold reserves in November, despite speculation that the country will be selling its gold in attempts to prop up the ruble. It seems the U.S. dollar bulls always find a way to put a spin on global events to somehow display their negative significance for the price of gold. In this case, the “Russia selling their gold” speculation has helped suppress the metal. Instead of selling gold to prop up the ruble, as many traders suspect, Russia has been attempting to supporting their currency by using other measures, including a surprise interest rate hike from 10% to 17.5%. However, the surprise rate hike failed to reverse the collapse of the ruble as it continued to devalue against the dollar.

Technicals:

- Support: $1,182.00

- Resistance: $1,238.25

- 50 day moving average: $1,201.86

- 200 day moving average: $1,266.02

- HUI/Gold Ratio: 0.138 (Last week 0.135)

Silver

Similar to gold, silver opened the week erasing all of the gains made the week prior. This was a result of a strengthening U.S. dollar, and expectations of the FOMC meeting. The selling the past week brought the metal back down into the $15 territory, and below the 50 day MA once again. Silver closed the week at $16.07, down 5.7%.

Technicals:

- Support: $15.04

- Resistance: $17.80

- 50 day moving average: $16.50

- 200 day moving average: $18.86

- Silver/Gold Ratio: 74.33

- XAU/Gold Ratio: 0.0581 (Last Week: 0.0562)

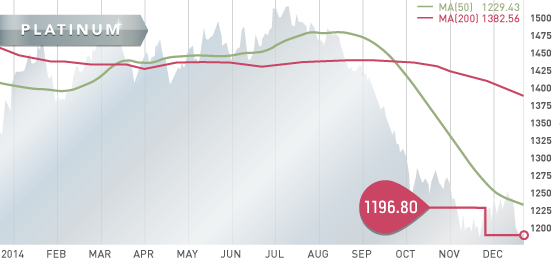

Platinum

Platinum finished the week down $31 or 2.5% to close a close once again below the 50 day moving average. With platinum closing at $1196.80, the declines this week have removed much of the gains made over the past three weeks, and has the metal once again hovering below $1200.

Technicals:

- Support: $1,177.50

- Resistance: $1,260.00

- 50 day moving average: $1,229.43

- 200 day moving average: $1,382.56

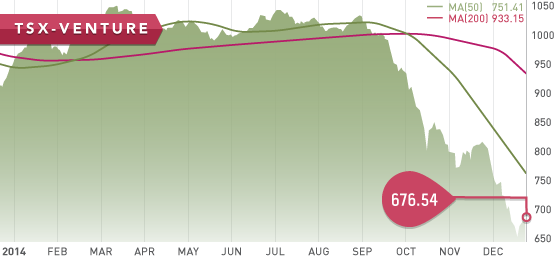

Both the TSX and the TSX-V were up on the week following three weeks of steady declines. The TSX was up 730.8 points (5.3%), and the Venture was up 22.76 (3.5%). Oil was volatile once again this week, reaching a low of $53.68 early Wednesday, and then exhibiting two failed rallies to the $59 level where it met solid resistance. The next level of support for oil, besides the psychological $50 mark, is at $45.37 which is a solid line of support since 1999. This would be a key level to monitor.

With December 24th being the last day for tax-loss selling in Canada and the US, we should see the final selling of many distressed miners this week, as we start to look forward to a new year ahead.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday Dec. 22

– Consumer Confidence (EA) – Consensus: -11.0

– Existing Home Sales (US) – Consensus: -0.6%

Tuesday Dec. 23

– GDP MoM (CAN) – Consensus: 0.1%

– GDP Growth QoQ (US) – Consensus: 4.2%

– Durable Goods Orders (US) – Consensus: 2.4%

– Consumer Sentiment Final (US) – Consensus: 93.5

– Personal Income/Spending MoM (US) – Consensus: 0.5%

– New Home Sales (US) – Consensus: 461K

Wednesday Dec. 24

– Initial Jobless Claims (US) – Consensus: 290K

Thursday Dec. 25

– Inflation, Employment, Industrial Production, Retail Sales(JPN)

It will be quiet for most of the holiday week, besides a number of U.S. data points out on Tuesday. Japan will be releasing a plethora of data on Thursday while many markets are closed for Christmas.

Last Week: The big event last week was the FOMC meeting. The members said they will remain “patient” in regards to hiking rates, and the decision to hike rates will be “data dependant”. Industrial production numbers out of the US last week were very strong. However, building permits and housing starts both fell in the month of November. Also lower was the Markit Flash US Manufacturing PMI for December.

Japans trade deficit shrunk in November as a result of increased exports and a decrease in imports. The drop in oil prices will be a big help to the ailing Japanese economy, and should help to shrink their trade deficit further.

Inflation in the US was lower then expected, largely attributed to declining oil price. However, the FOMC believes this lower inflation, as a result of lower oil prices, will be “transitory”. Inflation in Canada was lower as well, largely attributed to the declining oil price.

On Wednesday, the Tickerscores December 7th “stock of the week” pick, Paramount Gold and Silver (PZG.TO), announced the proposed buyout by Coeur Mining Inc. (CDE.NYSE). The shares of Paramount shot up 40 cents following the announcement to finish the week at $1.18, gaining 50% since Tuesday’s close.

With our Top 10 selection for 2015 finalized, Tickerscores is now assembling the report which we anticipate will be out at the beginning of January. Nevada Developers is nearing completion and should be updated over the holidays.

![]()

- Symbol: KTN.V

- Price: $0.28

- Shares Outstanding: 70,110,683

- Market Cap: $ 19.6 million

- Cash: $2.66 million (As of Sept. 30)

- Significant shareholders: Agnico Eagle (9%), Management and Directors (16.7%)

Kootenay Silver (KTN.V) is developing their 100% owned Promontorio Silver Project in Sonora Mexico. The Project hosts the Promontorio deposit as well as the newly discovered La Negra deposit. Management and associates, are well aligned with shareholders, holding close to 17% of the shares. James McDonald, the company’s CEO, has bought over half a million shares this year, including 400,000 shares of the private placement in August. The company is also in strong hands, with Agnico Eagle Mines (AEM.TO) holding 9% of the company.

Promontorio

The Promontorio deposit is a polymetallic silver breccia system that contains a measured and indicated resource of 92 million silver equivalent ounces, and an inferred resource of 24 million silver equivalent ounces. This resource was calculated at much higher metal prices and so some discretion should be used when relying upon the numbers. However, there is no question that the grades are there as well as the ounces, just perhaps in not as much quantity at these current metal prices. In H2 of 2013, subsequent to the resource update at Promontorio, a new high-grade zone was discovered between the Pit and NE Zones. This new discovery will certainly help to add ounces to the next resource update. An updated resource estimate would be much welcomed by the market. This would include the additional drilling, as well as to reflecting the lower metal price environment. With that said, the Promontorio deposit still represents an established resource to build from, and will complement additional discoveries on the property such as La Negra.

La Negra

La Negra is a new discovery that Kootenay recently drilled during the third quarter. This phase one, 25 hole program, returned very encouraging results, and shows that La Negra is a polymetallic silver diatreme breccia complex, similar to the Promontorio deposit. The deposit is 6.5km from the Promontorio deposit and outcrops at surface. This is a situation that will benefit the economics of the Project, as it display the potential for a low-cost open-pit heap leach operation in close proximity to the already established Promontorio deposit. Highlights of the phase one program include hole LN-03-14 which returned 82.57 g/t Ag over 144 meters vertically from surface and ending in mineralization. Hole LN-21-14 returned 156.47 g/t Ag over 200 meters, also ending in mineralization. Kootenay is going back to La Negra early in the new year to commence a phase 2 drill program. This program will follow up on the success of the phase 1 program with the objective of producing an initial resource estimate of La Negra by mid-2015.

Bottom line

Kootenay is quietly adding ounces to their Promontorio Project, and with the recent success at La Negra, it appears more ounces are on their way. La Negra is a “game changer” for the company and will greatly add ounces to the story, as well as increase the economics of the Project. With additional drilling in early 2015 at La Negra, followed by a maiden resource estimate, Kootenay will have two deposits with 43-101 compliant resources. Kootenay could potentially develop a low-cost scenario, where multiple deposits are feeding a central processing facility. This scenario would be further improved if Kootenay is able to find similar success at the other 4 untested drill targets on the property. As Kootenay advances this project further, while also improving the apparent economics, we wouldn’t be surprised to see Agnico Eagle take a further position in Kootenay, or perhaps even buy them out. Agnico is in a healthy financial position, and is looking to further expand their footprint in Mexico. This is evident by their recent purchase of Cayden Resources. At $0.28 per share, we feel this represents a good value considering the upside potential that La Negra has now generated.

Potential Catalysts and Events to Monitor:

- La Negra Drilling (Early 2015)

- La Negra Maiden Resource (Mid-2015)

- Promontorio Resource Update

- Agnico Eagle Involvement

DEC