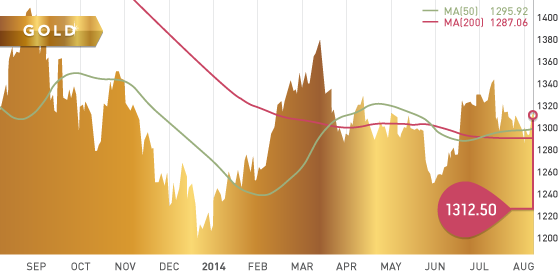

The yellow metal finished Thursday at $1,312.50 per ounce. So far this week, weakness in general equities and escalating tensions between Russia and Ukraine have pushed gold slightly higher. It is interesting to note that the US dollar traded at its highest levels since September 2013. The European Central Bank announced on Thursday that interest rates will remain low for an extended period of time.

In the short term, I continue to look for gold to remain range bound, between $1,280 and $1,320.

Technicals:

- Support: $1,281

- Resistance: $1,315

- 50 day moving average: $1,295.92

- 200 day moving average: $1,287.06

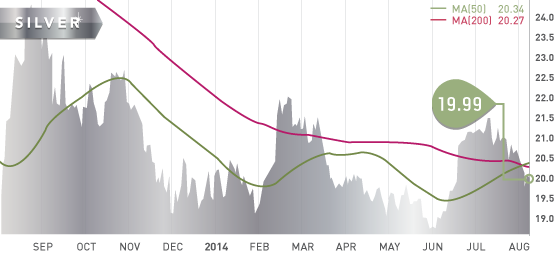

Silver Silver closed Thursday at $19.99 per ounce.

Technicals:

- Support: $19.70

- Resistance: $20.42

- 50 day moving average: $20.34

- 200 day moving average: $20.27

Platinum

Platinum closed the week at $1,481.50 per ounce.

Technicals:

- Support: $1,451

- Resistance: $1,488

- 50 day moving average: $1,474.51

- 200 day moving average: $1,436.11

A Look Ahead

The key items on the calendar this week are:

- August 12 Tuesday – Treasury Budget

- August 13 Wednesday – Retail Sales

- August 14 Thursday – Unemployment claims

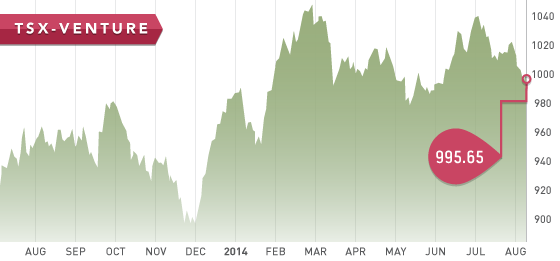

- August 15 Friday – PPI / 2nd quarter financials due for TSX companies

Mexico exploration companies were sent out on Wednesday.

Research is well underway for the Top 10 Stocks for the fall. I have found one company that I like to call baby, Franco Nevada (FNV.T), which will be included in the report. The potential for significant gains in this stock over the next few years is phenomenal. Stay tuned….

Updates:

Mart Resources (MMT.T) $1.34 – Investors looking for some speculation would be wise to take a hard look at Mart stock at these levels. A catalyst rich six months is starting, including a new pipeline. I see 50% upside from these levels before the end of the year if Mart can execute on its plans.

Solitario (SLR.T) $1.63 – We featured Solitario back on May 11th, and the stock was trading at $1.11 per share at the time. A final permit is expected in the next few week on the Mt. Hamilton project. The stock trades very thinly, but is still undervalued in my opinion.

Luna Gold (LGC.T) $0.98 – Luna Gold experienced a tough second quarter, blaming it on above average rainfall. Sandstorm Gold (SSL.T) has decided to invest another $19 million into Luna, and will own 19.8% of the shares. I would wait on purchasing Luna shares, but will keep watching the company. This one could be a good turnaround play later in the year. A video interview with Nolan Watson on the Sandstorm investment in Luna can be found here.

The top 10 stocks for 2014 performance is below:

| Overall return (10 stocks) | Top 5 |

| 39.82% | 59.28% |

| Company | Symbol | Jan 2014 price | Aug 7 price | Return |

| Rubicon | RMX.T | $0.92 | $1.61 | 75% |

| Timmins | TMM.T | $1.23 | $1.91 | 55.28% |

| USA Silver | USA.T | $0.35 | $0.47 | 34.29% |

| Royal Gold | RGL.T | $52.51 | $85.29 | 63.93% |

| B2Gold | BTO.T | $2.31 | $2.93 | 26.84% |

| Tahoe Resources | THO.T | $17.66 | $29.65 | 67.89% |

| Rio Alto Mining | RIO.T | $1.75 | $2.70 | 54.29% |

| Excellon | EXN.T | $1.14 | $1.32 | 15.79% |

| Orca Gold | ORG.V | $0.41 | $0.60 | 46.34% |

| Bayfield Ventures | BYV.V | $0.35 | $0.205 | -41.4% |

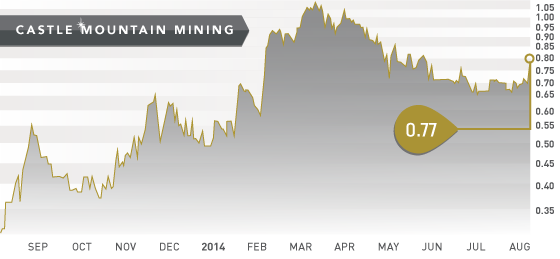

- Symbol: CMM.V

- Price: $0.77

- Shares Outstanding: 71,891,418

- Market Cap: $48,886,000

This week, we take a look at a gold development company, Castle Mountain Mining. Castle is looking to bring a past producing heap leach gold mine back into production. The mine is located in San Bernardino County, California and is permitted. A NI 43-101 issued in November shows a resource of over 4 million ounces at ~0.60 g/t.

A PEA (Preliminary Economic Assessment) was released at the end of April showing favourable economics. The base case operation would produce 176,000 ounces over 17+ years, which results in a $352 million NPV (5% discount rate) and an IRR of 20.1% at $1,300 gold. In the base case scenario, initial CAPEX would be $99 million with $173 million in sustaining capital.

Castle Mountain is fully cashed up, with $8.5 million in the treasury at the end of June. M3 Engineering and Technology Corp has been hired to complete a feasibility study, which is expected in Q1 2015. The funds will also be used for a phase 2 drilling program.

With Castle Mountain, investors get a project that has checked off many of the boxes to de-risk a mining project. At the current market cap, CMM has lots of potential upside.

AUG