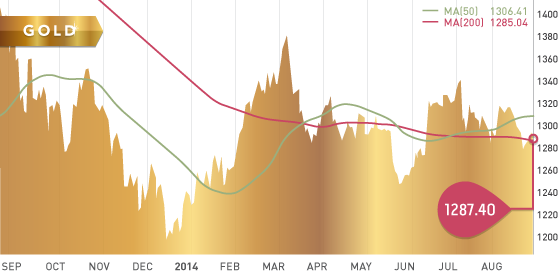

Gold had a fairly quiet week, closing at $1287.40. As the calendar turns into September, gold is entering historically its best month of the year. Gold continues to be range-bound with no catalysts to push the price in either direction. The spot price has traded in a range of <$50 in the month of August, which is the narrowest spread in five years.

In the short term, we continue to look for gold to remain range-bound, between $1,270 and $1,320. Gold traders will be watching the US unemployment rate next Friday.

Technicals:

- Support: $1,273.40

- Resistance: $1,300

- 50 day moving average: $1,306.41

- 200 day moving average: $1,285.04

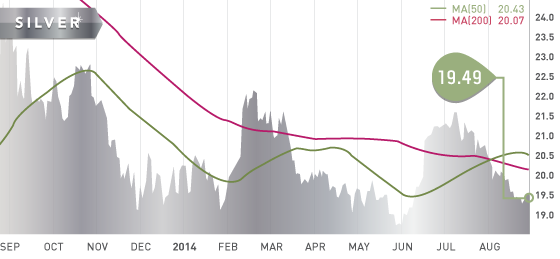

Silver

Silver closed at $19.49 per ounce. Silver is down 18% in the last year.

Technicals:

- Support: $19.35

- Resistance: $20

- 50 day moving average: $20.43

- 200 day moving average: $20.07

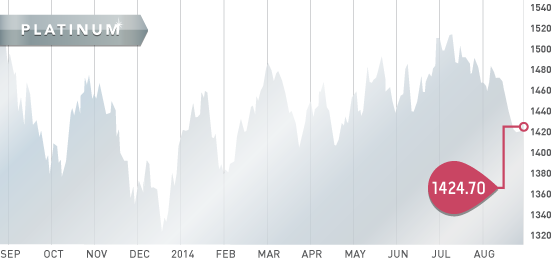

Platinum

Platinum closed the week at $1,424.70 per ounce, down almost $40 on the week. A report from Deutsche Bank released this week has targeted an average price of $1,467 this year, $1,575 in 2015, and $1,650 in 2016. Deutsche Bank expects the PGM metals to play an important role in reducing China’s pollution in the next several years. Palladium continues to outperform Platinum and is near 13 year highs at over $900 per ounce.

Technicals:

- Support: $1,400

- Resistance: $1,450

- 50 day moving average: $1,471.45

- 200 day moving average: $1,435.31

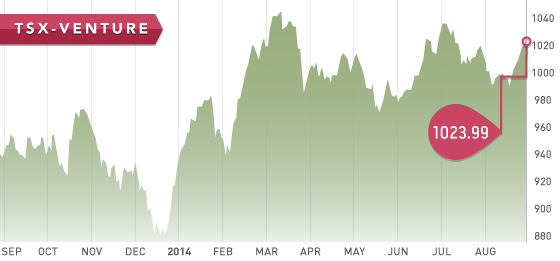

It was a good week for the TSX Venture with five consecutive green days, finishing the week at 1023.99. Energy stocks are the highest weighting behind the TSX Venture Index and continue to push it higher. Mining stocks remain subdued and will hopefully pick up in the upcoming months. All second quarter financials have been filed so be sure to check the cash positions of your investments.

A Look Ahead

The key items on the calendar this week are:

- September 1 Monday – US and Canadian markets closed (Labour day)

- September 3 Wednesday – Auto Sales

- September 4 Thursday – Unemployment Claims, Trade Balance

- September 5 Friday – Unemployment Rate

Research for the Top 10 Stocks to Watch for the fall is complete. Look for this exciting report in your inbox on Tuesday Sept 2nd. We will be back to regular updates starting next week with Quebec exploration and development companies.

If you have any questions please get in touch: james@tickerscores.com

The Top 10 stocks for 2014 performance is below:

| Return | Top 5 |

| 42.61% | 60.92% |

| Company | Symbol | January | Aug-29 | Return |

| Rubicon | RMX.T | $0.92 | $1.55 | 68.48% |

| Timmins | TMM.T | $1.23 | $1.89 | 53.66% |

| USA Silver | USA.T | $0.35 | $0.57 | 62.86% |

| Royal Gold | RGL.T | $52.51 | $84.55 | 61.94% |

| B2Gold | BTO.T | $2.31 | $2.80 | 21.21% |

| Tahoe Resources | THO.T | $17.66 | $27.84 | 57.64% |

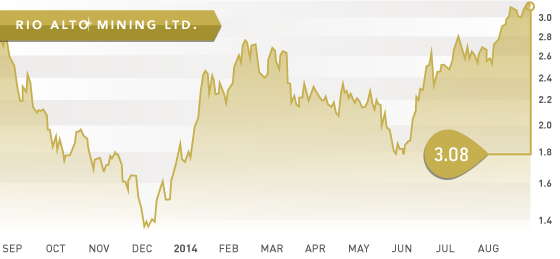

| Rio Alto Mining | RIO.T | $1.75 | $3.08 | 76% |

| Excellon | EXN.T | $1.14 | $1.40 | 22.81% |

| Orca Gold | ORG.V | $0.41 | $0.58 | 41.46% |

| Bayfield Ventures | BYV.V | $0.35 | $0.21 | -40% |

- Symbol: RIO.T

- Price: $3.08

- Shares Outstanding: 330,514,073

- Market Cap: $1,031,204,000

- Cash: $29,187,000 (June 30,2014)

This week, we feature a profitable mid-tier gold producer, Rio Alto Mining. Rio is coming off an excellent second quarter with net earnings of $15.2 million (9 cents per share). Rio operates the La Arena mine in Peru which is a steady low cost producer with an estimated all in sustaining cost of between $990-$1094 per ounce in 2014. The mine currently produces oxide ore which is expected to last until 2017. After 2017 phase 2 will need to be developed and will be sulphide ore producing copper and gold.

Rio made completed a merger with Sulliden Gold on August 5th. We feel this is an excellent move by Rio and will deliver growth in the years to come. The last three years have seen Rio hold steady around 200,000-215,000 ounces produced per year. The acquisition will allow for production growth of roughly 40% up to 304,000 ounces by the end of 2016.

Bottom line: Rio Alto is a low cost producer with an excellent growth profile moving forward. With a low all in sustaining cost, RIO provides excellent downside risk if the gold price falls.

Catalysts:

- Engineering studies at Shahuindo (Q4)

- Oxide drilling at La Arena (September)

- La Arena phase 2 feasibility study (Q4)

- New resource estimate at La Arena (January 2015)

AUG