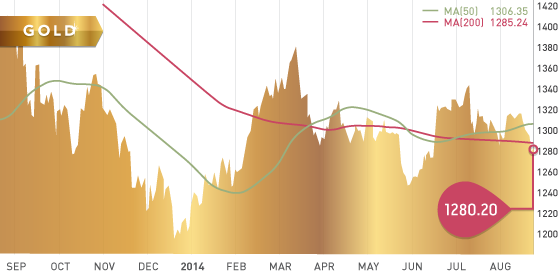

Gold dropped $26 on the week, closing at $1,280.20 per ounce. The week started with little movement in price, before dropping close to $20 after the FOMC minutes on Thursday. All signs coming from the Fed show the US economy continuing to improve. Data out of Europe continues to be weak and the US dollar has had a significant move since June. Gold has yet to start its seasonal rally. Russia continues to add gold to its reserves, adding 9.4 metric ($400 million) tons in the month of July.

In the short term, I continue to look for gold to remain range bound, between $1,280 and $1,320. Gold traders will be watching economic news out of Europe and the US next week.

Technicals:

- Support: $1270

- Resistance: $1300

- 50 day moving average: $1306.35

- 200 day moving average: $1285.24

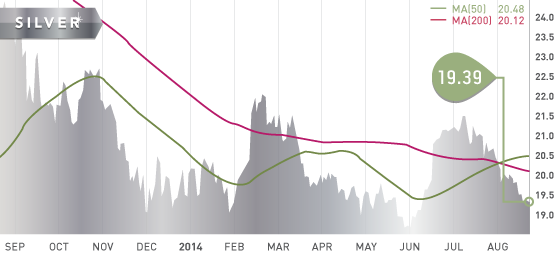

Silver

Silver closed at $19.39 per ounce. Investors should note the expiration of September options, which occurs next Tuesday.

Technicals:

- Support: $19

- Resistance: $20

- 50 day moving average: $20.48

- 200 day moving average: $20.12

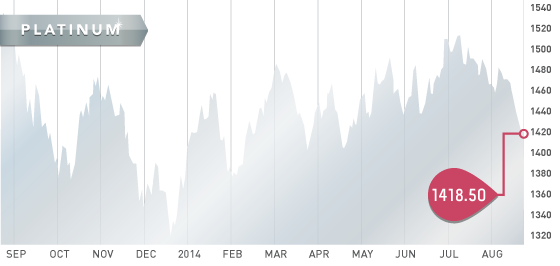

Platinum

Platinum closed the week at $1,418.50 per ounce, down almost $40 on the week. Chinese platinum imports fell to 152,900 ounces for June, the lowest level since February 2013. Platinum’s sister metal, Palladium, hit a 13 year high briefly this week. Interesting to note, Palladium demand is up 31% annually for the year to July.

Technicals:

- Support: $1400

- Resistance: $1450

- 50 day moving average: $1474.09

- 200 day moving average: $1435.92

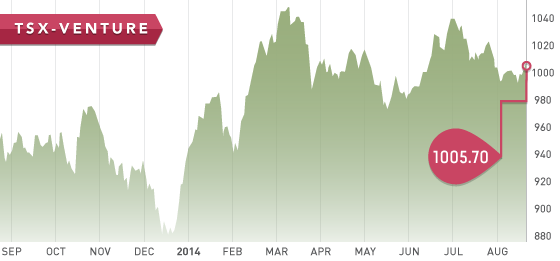

The TSX Venture continues remain fairly quiet, finishing the week at 1005.70. Financials are starting to trickle in before the end of month deadline. At a quick initial glance, cash positions continue to decline and are getting to worrisome, low levels. This is definitely a market to be extremely selective in and only purchase the higher quality names. Excellent value can still be had in the higher quality names.

A Look Ahead

The key items on the calendar this week are:

- August 25 Monday – New Home Sales

- August 26 Tuesday – Consumer Confidence

- August 28 Thursday – Unemployment Data, GDP Second Quarter Estimate, Pending Home Sales

- August 29 Friday – Personal Income and Spending, Chicago PMI

Nevada exploration companies have hit your inbox, with the highest score given to Nevada Exploration (NGE.V).

Research for the Top 10 Stocks to Watch for the fall is nearing completion. I am very happy with the way it is coming together and I am confident these stocks will outperform in the next several months. The fall is usually a strong period of seasonality for precious metals, so the timing of this report is perfect.

The top 10 stocks for 2014 performance is below:

| Overall return (10 stocks) | Top 5 |

| 35.67% | 52.95% |

| Company | Symbol | Jan 2014 price | Aug 15 price | Return |

| Rubicon | RMX.T | $0.92 | $1.49 | 61.96% |

| Timmins | TMM.T | $1.23 | $1.78 | 44.72% |

| USA Silver | USA.T | $0.35 | $0.50 | 42.86% |

| Royal Gold | RGL.T | $52.51 | $82.81 | 58.61% |

| B2Gold | BTO.T | $2.31 | $2.73 | 18.18% |

| Tahoe Resources | THO.T | $17.66 | $27.66 | 56.63% |

| Rio Alto Mining | RIO.T | $1.75 | $2.96 | 69.14% |

| Excellon | EXN.T | $1.14 | $1.16 | 1.75% |

| Orca Gold | ORG.V | $0.41 | $0.58 | 41.46% |

| Bayfield Ventures | BYV.V | $0.35 | $0.21 | -40 % |

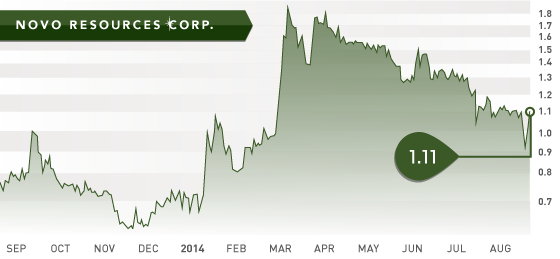

- Symbol: NVO.C

- Price: $1.11

- Shares Outstanding: 57,442,558* (*6,646,047 shares not included in escrow account for potential transaction)

- Market Cap: 63,761,000

Cash: $10,345,254 (June 30,2014)

This week, we feature a very interesting exploration company, Novo Resources. Novo Resources is exploring for gold in Australia and is led by Dr. Quinton Hennigh. Novo has a 70% interest in the Pilbara Gold project, which shares many similarities to the Witwatersrand Basin in South Africa. This is significant because the Witwatersrand Basin is host to the largest gold field on earth.

The Pilbara gold project consists of two separate projects: Beatons Creek and Marble Bar. Novo is exploring for gold-bearing conglomerates (reefs) at both projects. Beatons Creek is more advanced with a NI-43-101 maiden resource of 421,000 oz of gold, at 1.47 g/t. The inferred resource was defined by only 16,107 metres of drilling, at a cost of roughly $2.5 million. A bankable feasibility study is expected to be delivered in 2014.

Bottom line: Novo Resources is an exciting exploration stock that is well funded to carry out future plans. The initial results at the Pilbara project are very interesting. The results so far are have been interesting enough to warrant an affiliate of Newmont Mining purchasing 28% of the stock. As always, exploration stocks are high-risk/high-reward, but keep an eye on this one.

AUG