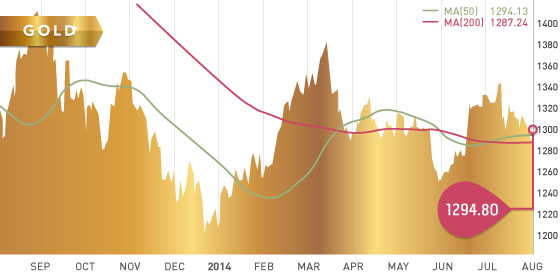

It was an interesting week for gold. The yellow metal finished the week at $1,294.80 per ounce, down $13. Gold did get a bounce on Friday, finishing up $13.40 after the US jobs report data was released. The unemployment rate climbed to 6.2%, which could mean the Fed will push back the rising of interest rates. The bounce was not enough to offset losses earlier in the week and marked the third consecutive negative week for the yellow metal.

As far as next couple weeks go, we would look for gold to remain range bound between $1,280 and $1,320. On the bullish side, we have demand for physical gold picking up as weddings/festivals season starts in September. Gold bears continue to focus on the US economy and the end of tapering and possible increase of interest rates.

Technicals:

- Support: $1,278

- Resistance: $1,300

- 50 day moving average: $1,294.13

- 200 day moving average: $1,287.24

Silver

Silver closed the week at $20.37 per ounce. Silver is up 3.90% year to date.

Technicals:

- Support: $21

- Resistance: $20

- 50 day moving average: $20.28

- 200 day moving average: $20.30

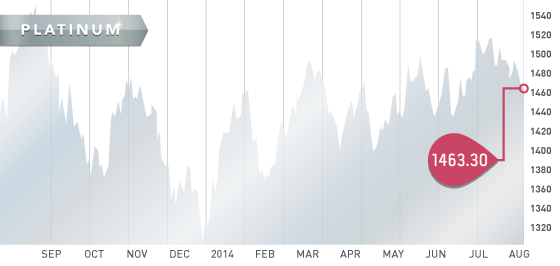

Platinum

Platinum closed the week at $1,463.30 per ounce. We continue to be bullish on platinum looking forward; for many operations, it is unsustainable at the current price.

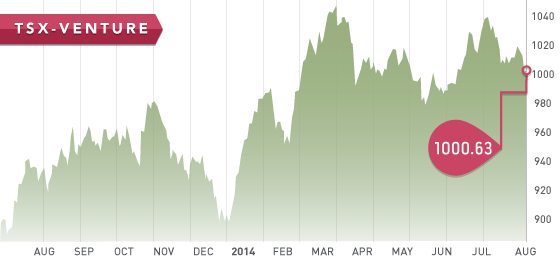

The TSX venture was fairly quiet this week, finishing at 1000.63, down 17 points. As we predicted, the venture is seeing some seasonal weakness. In the month of July, the exchange was down 36 points after closing July 2nd at 1036.07. August will be an interesting month and I expect more weakness.

The US market has rolled over the last couple days and will be interesting to watch, as any weakness here will also happen in the Canadian markets.

We are excited about our upcoming Top 10 Report for the fall! We will be spending countless hours looking for the higher quality names, while being super selective.

A Look Ahead

The key items on the calendar this week are:

- August 4th Monday – Canadian Markets closed / US markets open

- August 5th Tuesday – ISM Services

- August 6th Wednesday – Trade Balance

- August 7th Thursday – Unemployment Claims / Consumer Credit

Mexico companies, both exploration and development, are complete.

Nevada companies are in the designer queue.

We will be focusing exclusively on our Top 10 stocks for the fall, beginning next week. The goal is to send out this report in the third week of August.

Update: Seabridge Gold (SEA.T), one of our Top 10 Summer stocks, received a provincial environmental approval this week. There was a good move in Seabridge stock this week, putting the company up 22.92% since we released the report.

The top 10 stocks for 2014 performance is below:

| Overall return (10 stocks) | Top 5 |

| 43.33% | 67.11% |

| Company | Symbol | Jan 2014 price | Aug 1 price | Return |

| Rubicon | RMX.T | $0.92 | $1.65 | 79.53% |

| Timmins | TMM.T | $1.23 | $2.00 | 62.60% |

| USA Silver | USA.T | $0.35 | $0.58 | 65.71% |

| Royal Gold | RGL.T | $52.51 | $83.25 | 59.45% |

| B2Gold | BTO.T | $2.31 | $2.88 | 24.68% |

| Tahoe Resources | THO.T | $17.66 | $29.24 | 65.87% |

| Rio Alto Mining | RIO.T | $1.75 | $2.54 | 45.14% |

| Excellon | EXN.T | $1.14 | $1.37 | 20.18% |

| Orca Gold | ORG.V | $0.41 | $0.60 | 46.34% |

| Bayfield Ventures | BYV.V | $0.35 | $0.215 | -38.57% |

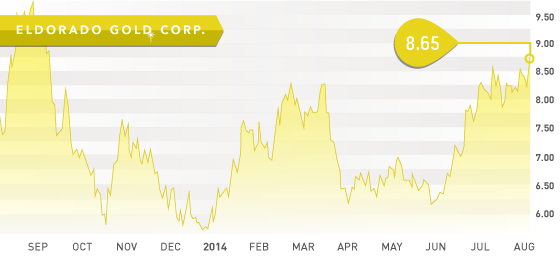

- Symbol: ELD.T

- Price: $8.65

- Shares Outstanding: 716,24,610

- Market Cap: $5,794,451,000

This week, we take a look at mid-tier gold producer, Eldorado Gold. Eldorado caught our eye this week after posting solid Q2 earnings of $37.6 million (5 cents per share). Production in the quarter was 200,551 ounces, at an all in sustaining cost of $850 per ounce.

Eldorado operates six mines worldwide, with forecasted production of approximately 790,000 ounces in 2014. Looking at the second quarter, all mines operated efficiently, which is a rare occurrence in the mining industry. A strong balance sheet of $584.4 million in cash and a $375 million credit line provides flexibility for a possible acquisition. Management has issued a dividend of 1 cent per share that will be paid in August.

The flagship mine is the Kisladag gold mine in Turkey, which produced 72,815 ounces in the quarter. A positive Environmental Impact Assessment (EIA) was received in June. This is an important permit and will allow ELD to expand to 20 million tonnes per year by mid 2016. The production increase will be only 10% to 20% though, as ELD has been running above reserve grade at this mine for the last couple years.

Bottom line, if you want to own a gold producer with one of the lowest all in sustaining costs, Eldorado is your stock. I can easily see Eldorado moving past $10 a share in the next few months.

AUG