Gold continues to trade around the $1,300 level, closing at $1,306.20 per ounce. As has been the story for the last several months, political risk is supporting the price and the US economy’s recovery is putting pressure on it. The World Gold Council issued a report on Thursday, stating a 16% drop in global gold demand in the second quarter. The report states that gold production remains strong and is at record levels.

In the short term, I continue to look for gold to remain range bound, between $1,280 and $1,320. Gold traders will be watching the FOMC minutes next Wednesday.

Technicals:

- Support: $1,281

- Resistance: $1,324.30

- 50 day moving average: $1,303.45

- 200 day moving average: $1,286.05

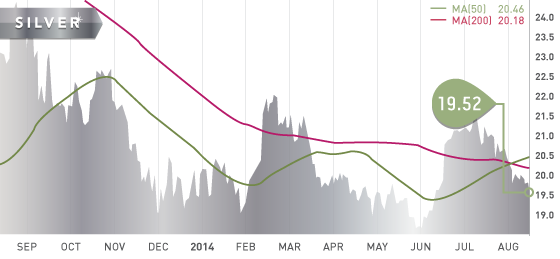

Silver

Silver closed at $19.52 per ounce, just above support and below both the 50 and 200 day moving averages.

Technicals:

- Support: $19.50

- Resistance: $20.25

- 50 day moving average: $20.46

- 200 day moving average: $20.18

Platinum

Platinum closed the week at $1,457.20 per ounce. Impala platinum, the second largest producer, announced that profit declined 75% year-over-year, largely due to the strike.

Technicals:

- Support: $1,425

- Resistance: $1,470

- 50 day moving average: $1,477.37

- 200 day moving average: $1,436.57

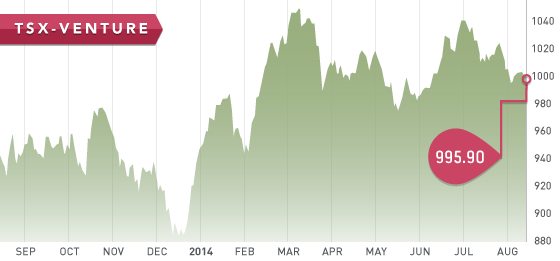

The TSX Venture continues to spin its wheels as the summer doldrums continue. It closed the week at 995.90. Jeff published an article on the Tickerscores blog showing the separation we are seeing between companies in the database. It will be interesting to update the companies after second quarter financials. All stocks listed on the TSX have now filed Q2 financials. The companies on the TSX Venture have until the end of the month.

A Look Ahead

The key items on the calendar this week are:

- August 19 Tuesday – CPI / Housing data

- August 20 Wednesday – FOMC minutes

- August 21 Thursday – Employment data / Leading Indicators

Mexico development companies have hit your inbox.

Research for the Top 10 Stocks to Watch for the fall is about 60% complete. Look for this report to be issued later this month.

Updates:

Mart Resources (MMT.T) $1.36 – Mart issued second quarter results this week, stating the new pipeline will be done in the next few weeks. The pipeline will result in a major increase in production and cash flow. I feel very strong on the opportunity of Mart at these levels, and plan on adding to my position in the next few weeks. Remember, this stock is in Nigeria and is a very high risk/reward stock.

Cayden Resources (CYD.T) $2.89- Cayden stock is on a tear since it was the stock of the week on June 15th at $1.73. More to come on Cayden, as it will be one of our Top 10 stocks to watch for the Fall.

The top 10 stocks for 2014 performance is below:

| Overall return (10 stocks) | Top 5 |

| 40.29% | 57.95% |

| Company | Symbol | Jan 2014 price | Aug 15 price | Return |

| Rubicon | RMX.T | $0.92 | $1.48 | 60.87% |

| Timmins | TMM.T | $1.23 | $1.86 | 51.22% |

| USA Silver | USA.T | $0.35 | $0.54 | 34.29% |

| Royal Gold | RGL.T | $52.51 | $86.09 | 64.89% |

| B2Gold | BTO.T | $2.31 | $2.87 | 24.24% |

| Tahoe Resources | THO.T | $17.66 | $27.99 | 58.49% |

| Rio Alto Mining | RIO.T | $1.75 | $2.97 | 69.71% |

| Excellon | EXN.T | $1.14 | $1.27 | 11.40% |

| Orca Gold | ORG.V | $0.41 | $0.60 | 46.34% |

| Bayfield Ventures | BYV.V | $0.35 | $0.215 | -38% |

- Symbol: KGI.T

- Price: $4.95

- Shares Outstanding: 72,074,117

- Market Cap: $356,046,000

Cash: $41 million (Mar 31,2014)

Debt: $120 million convertible debenture due 2H 2017

This week, we feature a gold producer in Ontario, Kirkland Lake Gold. Kirkland Lake caught my eye this week, issuing excellent quarterly production results. The results were the strongest in the company’s history, with 40,528 ounces of gold produced at a grade of 15.4 grams per tonne in the quarter. Investors will be waiting on the financial results to see if they turned a profit.

Kirkland Lake is a turnaround story, which I am big fan of following in the mining sector, if we can time it right. The new management team, led by George Ogilvie, has implemented a new mine plane of lower tonnage and higher grade. All expansion capital projects are now complete, and the focus will be on becoming profitable.

Bottom line: If Kirkland Lake can continue to improve operational efficiency and start to generate free cash flow, the stock will be much higher. The stock was as high as $20 a few years ago; not saying it will get that high again, but lots of room to the upside.

AUG