Gold

Gold was up slightly last week in an abbreviated four-day session to close at $1202.50, thanks to a strong performance on Wednesday. Some have attributed the gains on Wednesday to leaked non-farm payroll (NFP) numbers prior to Friday’s release. The gold market was closed for trading on Friday and not able to participate in the sell-off of the U.S. dollar after the NFP data came in well below expectations.

With the labour market one of the few areas supporting a near-term rate-hike, the disappointing NFP data on Friday will certainly weigh on the U.S. dollar and support gold in the near-term. As we have continually mentioned, the strength of the labour market in the U.S. does not appear to be as robust as the headline numbers have appeared on surface. There remains multiple question marks, such as the sluggish wage growth and declining participation rate.

Although the weak NFP numbers on Friday brought these concerns closer to the surface, we will still need to see a couple more months of labour market data to determine if this outlier can truly be blamed on the weather, or if it is in fact a proper representation of the health of the U.S. labour market.

Technicals:

- Support: $1,183.50

- Resistance: $1,236.70

- 50 day moving average: $1,212.77

- 200 day moving average: $1,237.34

- HUI/Gold Ratio: 0.139 (Last week 0.139)

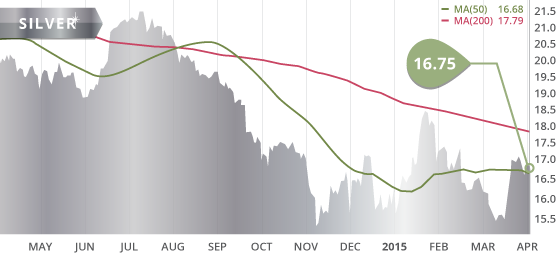

Silver

Silver was down 1.3% on the week to close the abbreviated session at $16.75, although the metal was able to remain above the 50 day MA for the second straight week. The metal will look to test the underside of the 9-month descending trend line, in place from the $21.55 high of July 10th. If the metal is able to break through that trend line, it will be looking to test the $17.75 level, an area which also coincides with the 200 day MA. Near-term the metal should follow gold as the market continues to digest the disappointing NFP numbers.

Technicals:

- Support: $16.43

- Resistance: $17.75

- 50 day moving average: $16.68

- 200 day moving average: $17.79

- Gold/Silver Ratio: 71.79

- XAU/Gold Ratio: 0.0565 (Last Week: 0.0565)

Platinum

Platinum continues to strengthen off of the mid-March low. The metal closed the week at $1154.80, up $14.50 on the week, and up over $60 since mid-March. The metal gained $40 off of the intraday low put in on Tuesday, which appears to be short-term support for the metal. Palladium was also up on the week despite putting in a fresh new 14-month low on Monday.

Technicals:

- Support: $1,114.70

- Resistance: $1,196.80

- 50 day moving average: $1,179.06

- 200 day moving average: $1,294.05

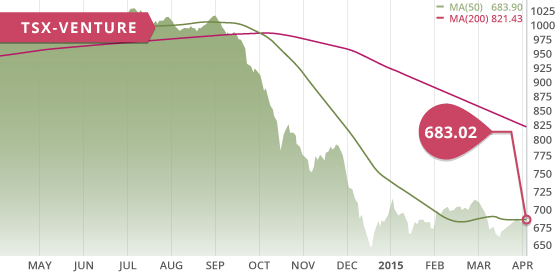

The TSX gained 1.45% on the week, while the TXS-V was up slightly to close at 683.02. The mining sector was down slightly despite the gold sector gaining 1.13%, and the base metal sector gaining 1.07% on the week. Copper closed at $2.73 on the session as it continued to give back the gains of the prior week when it hit $2.90 per pound.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday April 6

- ISM Non-Manufacturing PMI (US) – Consensus: 56.5

Tuesday April 7

- JOLTs Job Openings (US) – Consensus: 5.01M

Wednesday April 8

- BoJ Press Conference (JPN)

- FOMC March Meeting Minutes (US)

Thursday April 9

- Initial Jobless Claims (US) – Consensus: 281K

Friday April 10

- Inflation Rate YoY (CHN) – Consensus: (-4.7%)

- Employment Change (CAN) – Consensus (-0.10K)

Aside from the FOMC minutes from the March meeting, this week is a fairly quiet week for economic data. However, there is plenty of commentary from Fed members and central bankers on the docket. These statements always have the potential to move the markets. There are five separate speeches throughout the week from three different members. Also, the initial jobless claims and JOLTs job openings will be closely watched, and will carry a lot more weight following the dismal non-farm payroll numbers from last Friday.

Last Week: As we mentioned last week, the U.S. labour market has shown several signs of fragility despite the widespread view that it is robust. However, the release of the non-farm payrolls on the holiday Friday came in well below expectations, including downward revisions to the past two NFP job gains, and showed that there remains significant question marks about the perceived strength of the labour market. The disappointing jobs numbers have most likely removed the prospect of a June rate-hike and perhaps even moved it more towards the end of the year.

The Ontario Developers update will be finalized and released this week, and we will be working on our next Tickerscores update – Quebec Developers. We will also be narrowing down our shortlist for the Top 10 Spring Report, which we anticipate to have complete by the end of April or Early May.

Top 10 Updates:

Silvercrest Mines (SVL.TO) released an updated pre-feasibility study on their Santa Elena Mine, as well as renewed the 8 year mine life. The updated study generated a base case after-tax NPV5% of $119 million USD. The company also announced updates to the resources and reserves at Santa Elena.

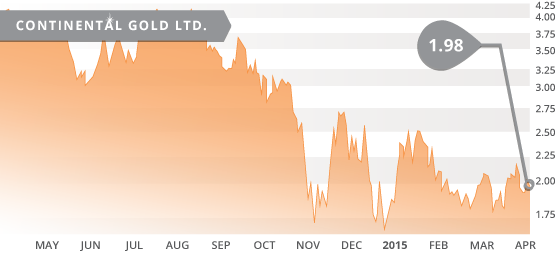

- Symbol: CNL.TO

- Price: $1.98

- Shares Outstanding: 127,218,758

- Market Cap: $251.9 Million

- Cash: $50 million

- Significant Shareholders: Van Eck Global (12.5%), Wellington Management (11.9%), Tocqueville (4%)

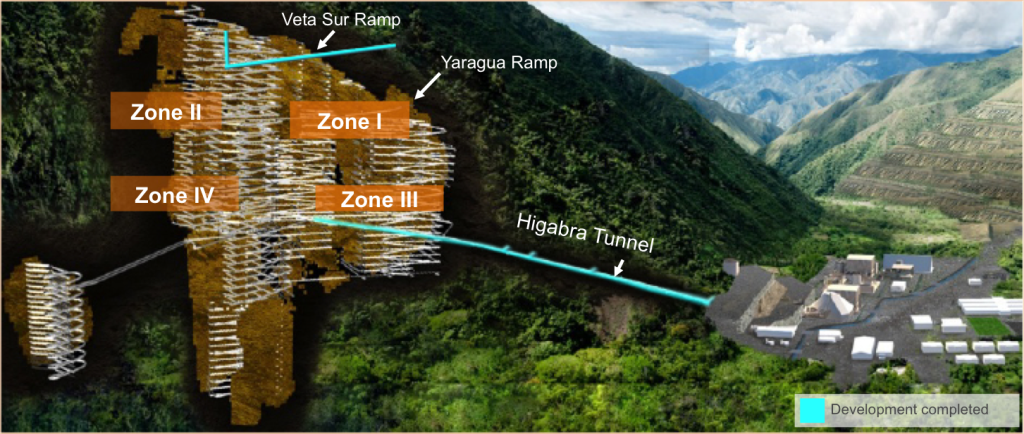

Continental Gold Ltd. (TSX:CNL) (OTCQX:CGOOF) is a Canadian mining company developing their 100% owned Buritica Gold Project in Antioquia, Colombia. The project hosts a high-grade gold system with a sizable resource, and boasts an impressive economic scenario displayed in the recently completed preliminary economic assessment (PEA). There are few deposits of this caliber that can still be found, aside from other notable high grade deposits like Pretium Resources Brucejack Project.

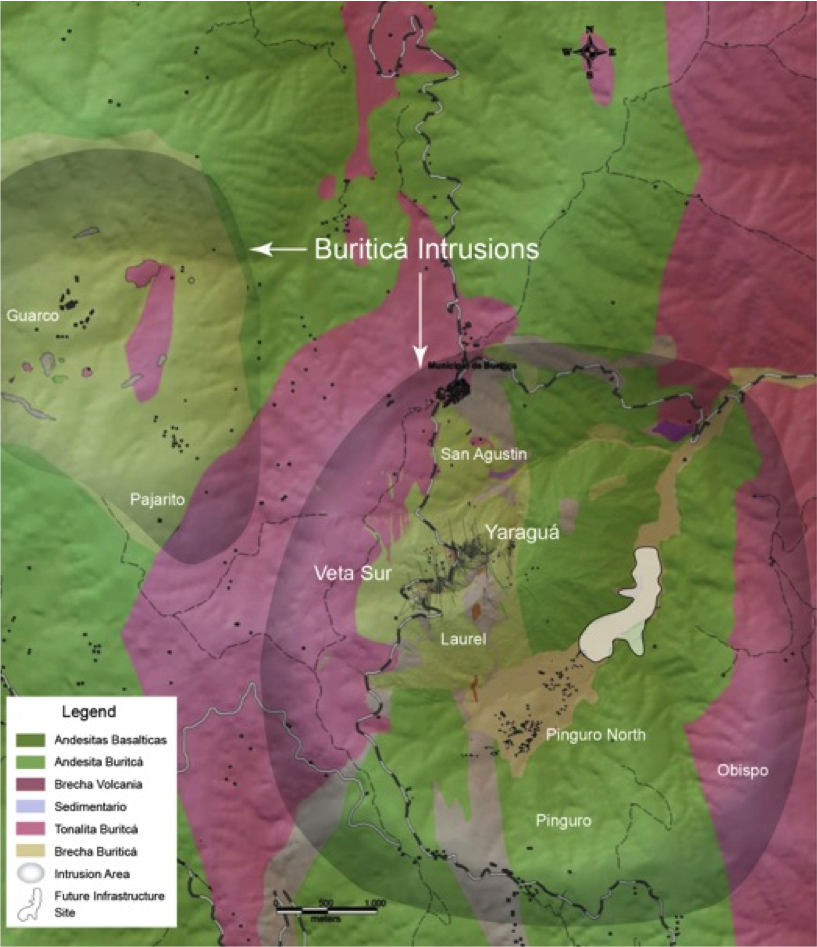

The mineralization at the Buritica Project is a porphyry-related, carbonate base metal (CBM) gold vein/breccia system. This high-grade gold system of sheeted veins, stockworks, and breccias, occurs over considerable verticals depths in excess of one kilometer, and remains open at depth and along strike. The deposit consists of two main vein systems, the Yaragua vein system, and the Veta Sur vein system. Both vein systems combine to form the current resource, with Yaragua contributing the majority of the ounces (over 60%).

The mineral resource of Yaragua and Veta Sur is based on 206,717 meters of drilling from 2,756 holes. Using a $1200 gold price and a cut-off grade of 3 g/t, the Buritica Project hosts a measured and indicated (M&I) resource of 8.39 million tonnes grading 10.4 g/t of gold containing 2.8 million ounces. In the inferred category the resource contains 16.7 million tonnes grading 7.8 g/t of gold for 4.2 million ounces. The deposit also contains notable silver and zinc mineralization which both contribute towards a gold equivalent grade of 11.0 g/t and 8.2 g/t for the (M&I) and inferred resource respectively.

This most recent resource contains all drilling up to the end of 2013. However, a 65,000-meters drill program was launched in 2014, which will be included in the updated resource estimate expected by mid-2015. This update should increase the global ounces contained within the current resources, as well as upgrade some of the ounces in the inferred and indicated categories into the indicated and measured categories respectively.

The recently completed maiden PEA showed the initial capital cost of the project coming in at $390 million, including $61.4 million in contingencies. Over a mine life of 18 years, the project will require $347 million in sustaining capital. Using a gold price of $1200 and a 5% discount, the after-tax NPV5% of the project is $1.1 billion, with an IRR of 31.5% and a payback of 2.8 years. The low-cost nature of the deposit, coupled with the high-grade mineralization and excellent metallurgy, generates this robust economic scenario. The company also took a conservative approach in the PEA by assuming that all material located outside of the hard boundaries of modeled veins has a value of 0 g/t. This conservative scenario generates an overall average mining dilution of 58%, which is quite high. However, the material outside of the hard vein boundaries is clearly not 0 g/t, and recent underground sampling of cross-cut development continues to substantiate this, and should help improve the economics of an updated PEA, namely by lowering the dilution factor and increasing the ounces produced.

The company completed the development of the Higabra Valley Tunnel (HVT) in 2014, as well as the Veta Sur and Yaragua ramps. These developments have allowed the company to complete underground drilling and sampling, with the goal of improving the quality and size of the resource. The underground drilling has extended several vein sets, as well as indentified new mineralization outside of the current resource. In addition, cross-cut development has identified significant mineralization in between the master veins, which should help to improve the overall grade of the resource inventory, and potentially generate wider mining stopes than those outlined in the PEA. The encouraging cross-cut program will also improve on the known metal grades for calculating dilution between master veins (assumed to be 0 g/t at this point). Underground cross-cut sampling to date has displayed encouraging results, such as a high-grade zone in the Veta Sur vein system that comprised of 3.25 meters (true horizontal width) grading 59.7 g/t of gold and 139 g/t of silver along 85 meters.

The company will complete an updated PEA by the end of 2015, which will include the 65,000 meter drill program as well as the underground sampling of cross-cuts and drifts. This additional data will surely improve the quality and size of the resource and in turn improve on the already impressive economics. In addition to the resource expansion potential of the Veta Sur and Yaragua deposit, there are multiple high-quality targets in close proximity to the deposit. In the case of the Laurel Area target directly southeast of the deposit, this zone could potentially share the underground infrastructure of the Buritica mine should an economic resource be discovered in the area. Further to the southeast is the Pinguro and Obispo vein targets which are expected to be drilled in H1 2015.

Colombian miners are heavily discounted by the investment community as it has lost faith in the Colombian government and also questions the current permitting regime. However, Colombia has been reforming their regulatory framework with the aim of bringing it in line with international standards. This was recently displayed with Red Eagle Mining recently receiving their final environmental permit for their San Ramon deposit. The approval of San Ramon bodes well for other development-stage Colombian miners such as Continental Gold. With Buritica also an underground operation, like the San Ramon Project, it increases the possibility of approval since underground mining is historically familiar and more palatable to the Colombian community. Furthermore, the Colombian government has declared Buritica as a “Project of National Interest”, with the government and state agencies working with Continental to facilitate permitting. Continental expects to receive their final environmental permit by mid-2015. This will leave the Buritica fully permitted and would significantly de-risk and elevate the attractiveness of this project.

The company has $50 million in cash and no debt, which should be more than sufficient to advance the project through to a feasibility study. The company has a very solid management team and board of directors with considerable experience. With an impressive roster such as the one behind Continental, it is evident that these people have the ability to see this project through to construction and beyond.

In addition to Buritica, Continental also hold two high-quality assets; the Berlin Gold Project, and the Dominical Gold Project. Both of these projects have not seen any drilling by Continental, although they both display high-grade potential. The Berlin Mine was in operation from 1930-1946 and produced between 400,000 and 700,000 ounces of gold at a production grade of 16 g/t.

Bottom line

We feel that the company is an excellent long-term play, as the highly experienced team continues to de-risk the Buritica Project, and in parallel, continues to improve and expand the resource. The economics of the project are very impressive, and look to improve further when an updated PEA is completed by year-end. Once the final permit is received we believe this will immediately position Continental as a possible acquisition target with the major permitting hurdle out of the way (IAMGOLD is active in Colombia and in need of replacing ounces). The upside contained within the project is clearly evident with the expansion potential of not only the current resource, but also the adjacent high-quality targets. Although it is still early in its reformation, the Colombian regulatory regime looks to be improving and should begin to give investors more confidence in the countries mining sector once again.

Potential Catalysts and Events to Monitor:

- Pinguro and Obispo Drilling (H1 2015)

- Updated Resource Estimate (mid-2015)

- Final Environmental Permit (mid-2015)

- Updated PEA (H2 2015)

- Feasibility Study (2016)

- Possible Take-out Candidate

APR