Gold continues to trade around the $1,300 level and closed at $1,302.80. The gold market moved higher on Friday as tensions between Russia and Ukraine escalated. As far as physical demand goes, premiums in India are rising due to tight supply ahead of the second biggest buying festival of the year, Akshaya Tritiya (May 2nd). In China, demand is a little lower as the Yuan continues to be soft.

Gold investors and traders will be busy next week watching the Russia/Ukraine conflict, FOMC meeting, and U.S. unemployment data.

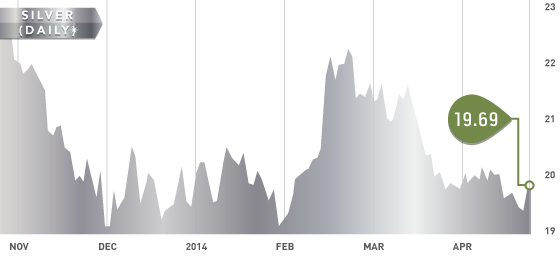

Silver continues to struggle to get any traction and is up 0.92% on the year. The majority of silver producers are losing money at the current price of silver.

Silver Chart

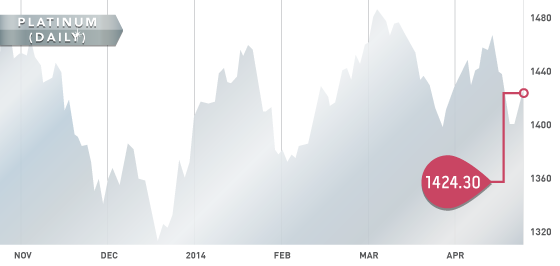

The Association of Mineworkers and Construction Union (AMCU) have declined to accept the latest wage offer from the producers. The producers have responded by saying they plan to take their offer directly to the miners. An estimated 10,000 ounces per day continue to be lost due to the strike. The price of platinum has not moved at all since the strike began, which indicates the market believes ample stockpiles of platinum are available

Platinum Chart

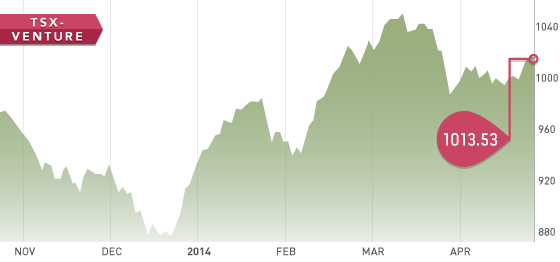

The TSX Venture had a positive week moving up 16 points to close at 1,039. As we approach May, we caution investors to be very selective when investing in junior mining stocks. The old saying “sell in May and go away” is typically a weaker period for the TSX Venture. We do not see many potential catalysts at this point and traders/speculators would be wise to have some cash available this summer for some bargain hunting.

TSX-V Chart

A Look Ahead

The key items on the calendar next week are:

• Tuesday April 29th – U.S. Consumer Confidence

• Wednesday April 30th – Audited Annual Financials due for TSX and TSX-V stocks

• Wednesday April 30th – FOMC rate decision

• Thursday May 2nd – U.S. unemployment rate

PGM producers have arrived in your inbox. Not many options in PGM stocks, but Stillwater Mining (SWC.T) is probably your best bet.

Next up is an update on Latin America producers (Q4), which should arrive in your inbox early next week. Ontario producers (Q4) will also go out next week.

Of note is that Citation Resources (CTT.V) received a takeover bid this week. This is the fourth “Stock of the Week” that has been taken over following Premier Royalty, Brigus Gold, and Osisko.

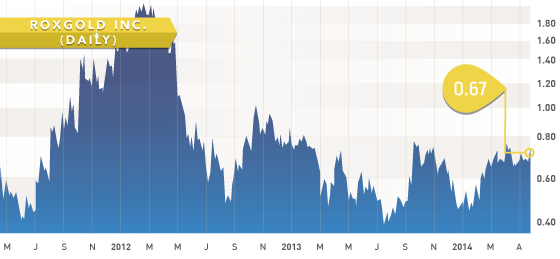

Symbol: ROG.V

Symbol: ROG.V

Price: $0.67

Shares Outstanding: 235,782,698

Market Cap: $162,690,000

This week we take a look at Roxgold, a gold development company in Burkina Faso, West Africa. Roxgold has the tag line “Best in Class” and it is one of the top gold projects in the world. A feasibility study was announced on April 22nd with robust economics highlighted by an after tax IRR of 48.4% at $1,300 gold. The project has a low CAPEX of $106.5 million and the average production grade will be 11.8 g/t (very high grade). The goal is to advance the project forward by completing financing and permitting in the next couple months, with underground development planned to commence in Q4. Like most gold charts, Roxgold has had a steep decline and was as high as $1.90 at the end of 2011. The downturn in the gold market has provided an opportunity with ROG to pick up a company with a world-class asset at a bargain price.

APR