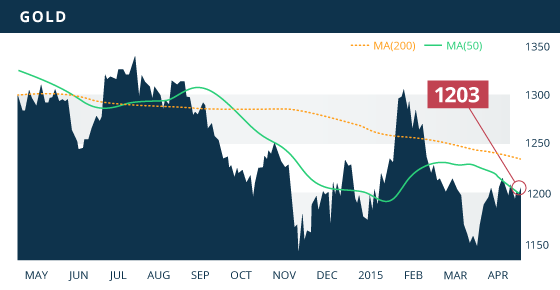

Gold

Gold was supported last week by a declining U.S. dollar, as the market was forced to stop turning a blind eye to the weak economic data perforating out of the U.S. The NFP numbers were recently shrugged off, as were the weak retail sales and the continuously poor manufacturing and production numbers. However, the market could not ignore the compounding weak data any longer, and in the process the dollar was sold off, and gold responded by bouncing off a 2-week low put in on Tuesday.

Gold closed the week down $4.30, although the metal was able to close above the 50 day MA for only the third time in 2 ½ months. There is solid support for the metal around the $1185 area, while solid resistance is reinforced at the $1228 area with both a 50% retracement mark as well as the declining 200 day MA. This area would be a very important hurdle for the metal to overcome, and one to watch for investors. The HUI/Gold ratio closed the week at a two-month high, an early indication that the miners are starting to find support again after the failed January rally.

Technicals:

- Support: $1,185.75

- Resistance: $1,228.50

- 50 day moving average: $1,197.21

- 200 day moving average: $1,231.65

- HUI/Gold Ratio: 0.147 (Last week 0.142)

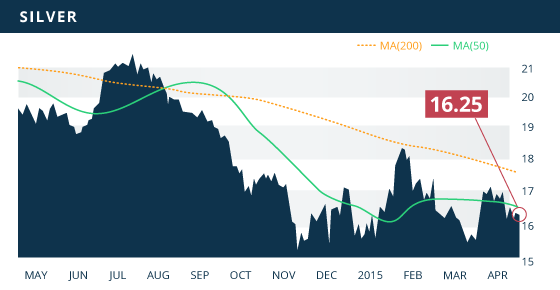

Silver

Silver continues to be subdued below the $17 level, and as we mentioned last week, there is a significant amount of resistance building in this area. The metal was unable to trade higher than $16.51 during the week, and ended the session at $16.25, down 1.5% on the week. This was the third straight week the metal has closed lower, all while the metal continues to obey the underside of the 50 day MA. Again, there is little technical support for the metal at these levels, and besides some near-term support at the $15.80 area, the March low of $15.27 remains a level of solid support. The metal will need a significant catalyst to chew through the resistance between these current levels and through the $17.50 area.

Technicals:

- Support: $15.80

- Resistance: $16.89

- 50 day moving average: $16.43

- 200 day moving average: $17.57

- Gold/Silver Ratio: 74.08

- XAU/Gold Ratio: 0.0589 (Last Week: 0.0573)

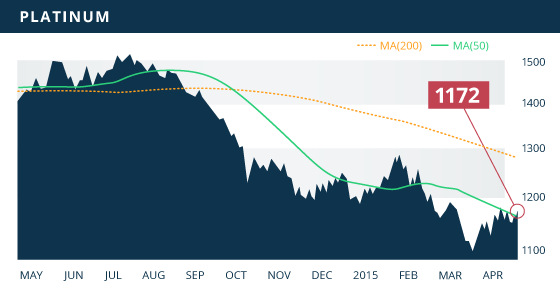

Platinum

Platinum fell slightly this week but continues to perform well. The metal was off $2.40 on the week after gaining back most of the ground lost during the first half of the weekly session. The metal found support at the $1140 level and rallied during the second half of the week to close the session at $1172. If platinum is able to hold above the $1136 level, it would signal this mini-bullish trend remains intact.

Technicals:

- Support: $1,136.10

- Resistance: $1,186.75

- 50 day moving average: $1,162.05

- 200 day moving average: $1,278.63

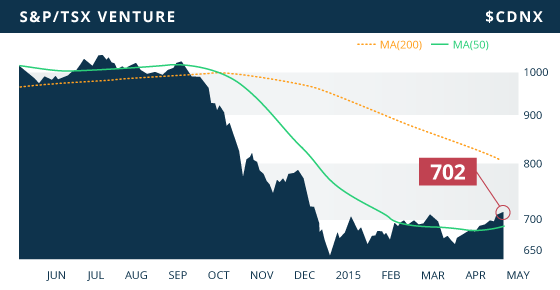

The TSX was off slightly on the week despite putting in a fresh 7-month high during intra-week trading. On the other hand, the VENTURE continued its steady climb and was up for the fifth week in a row, while breaking above 700 for the first time in two months. The VENTURE closed at 702.85 on the week, largely as a result of the energy sector gaining 3.68% to reach its highest point in 2015. oHhHowever, the mining sector was off 0.80% on the week, including the gold sector losing 0.58% and the base metal sector off 0.62%.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday April 20

- BoC Poloz Speech (CAN)

Wednesday April 22

- Existing Home Sales March (US) – Consensus: 5.05M

Thursday April 23

- HSBC Manufacturing PMI (CHN) – Consensus: 50.8

- Initial Jobless Claims (US) – Consensus: 290K

- New Home Sales March (US) – Consensus: 518K

Friday April 24

- Core Durable Goods Orders (US) – Consensus: 0.4%

- BoC Poloz Speech (CAN)

This is an unusually quiet week ahead for economic data, with the main items of focus being the Housing data, the Durable Goods Orders, and the Initial Jobless Claims. Both the Durable Goods and the Housing numbers have been weak areas of the U.S. economy, so they will be watched closely.

We continue to work through Quebec Developers which we will have updated by next week. We are also close to finalizing our Top 10 selections for our Spring report which we anticipate to have complete in May.

Top 10 Updates:

Silvercrest Mines (SVL.TO) announced record production of 465,391 ounces of silver, and 13,255 ounces of gold in the first quarter of 2015. The record production was the result of high-grade ore production from their underground operations now that they have made the transition.

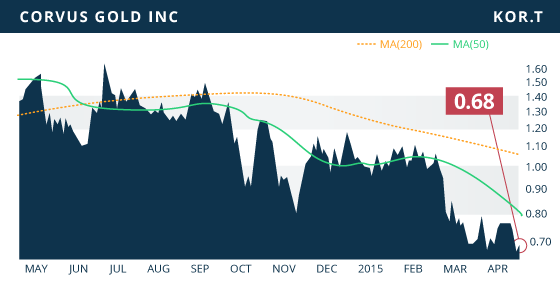

- Symbol: KOR.TO

- Price: $0.68

- Shares Outstanding: 80,083,928

- Market Cap: $54.5 Million

- Treasury: $7 million (as of February 28th)

- Significant Shareholders: AngloGold Ashanti (18.4%), Tocqueville (18%), Management and Board (8.1%)

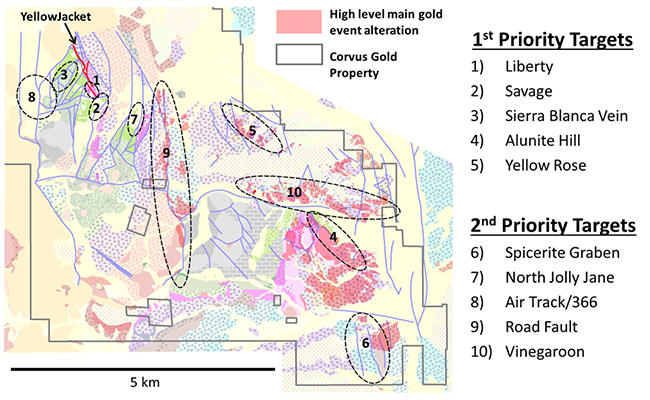

Corvus Gold Inc. (TSX:KOR) (OTCQX:CORVF) is a junior exploration and development company focusing on their 100%-owned North Bullfrog Project in southern Nevada. The 75 km2 North Bullfrog Project contains a sizeable resource consisting of six deposits, including the high-grade Yellowjacket deposit, as well as five oxidized disseminated heap leach deposits. This multiple deposit scenario has provided a situation where these deposits can all contribute to supporting a central processing facility. There is also considerable potential to expand on existing resources as well as discover additional deposits on the property, which is the aim of the upcoming 2015 drill program. The 2015 exploration program is fully funded, with the company in a solid financial position, with approximately $7 million in treasury and no debt. Corvus Gold, which was spun out from International Tower Hill Mines Ltd. (ITH.TO) in 2010, has a strong management team of former ITH and AngloGold Ashanti personnel. The management team collectively holds close to 8% of the shares, and the company is further supported by AngloGold and Tocqueville each holding 18% of the shares outstanding.

As mentioned, the North Bullfrog Project contains multiple deposits. The high-grade Yellowjacket deposit contains an indicated resource of 3.69 Mt at an average grade of 1.03 g/t gold and 5.52 g/t silver for 123,000 ounces of gold and 655,000 ounces of silver. In the inferred category, the deposit contains 18.4 Mt at an average grade of 0.94 g/t gold and 6.16 g/t silver for 555,000 ounces of gold and 3.64 million ounces of silver. The five oxidized disseminated heap leach deposits contain a combined indicated resource of 25.77 Mt at an average grade of 0.29 g/t gold for 240,000 ounces of gold, and an inferred resource of 186 Mt at 0.19 g/t gold for 1.14 million ounces of gold.

Using a gold price of $1200, the (after-tax) NPV5% of the oxidized heap leach deposits is $45.3 million, with an IRR of 10.9% and a payback of 7 years. Initial CapEx of the mine is $101 million with another $108.8 million in sustaining capital over the 11-year mine life. The numbers are not overly impressive and would require a higher gold price environment. However, the inclusion of the Yellowjacket resource defined in 2014 (to be updated along with the pending updated PEA), should significantly improve these numbers. The CapEx would increase as a result of incorporating additional processing infrastructure in order to process the Yellowjacket ore, perhaps in the range of $10-20 million depending on the optimized design.

The overall processing costs would also increase as a result of the higher processing costs associated with operating a milling circuit to process the Yellowjacket ore. However, the increased CapEx and Opex would be more than offset by the higher grade production. Also, if Corvus is able to expand the high-grade resources of the Project, then we could see these economics improve significantly. Judging by the 2014 drill results, we should see a meaningful increase in the Yellowjacket resource as well as an upgrading of a good portion of the inferred ounces.

In regards to processing the high-grade Yellowjacket ore, the company envisions a system that would include initial gravity separation (recent met tests displayed that 40% of the weighted average gold is recovered via gravity separation), followed by leaching of the gravity tailings either as an agglomerated product combined with the heap leach material, or in a standard CIL leach circuit. In the updated PEA, we will be given a better idea of the optimized processing flow sheet, as Corvus woks the high-grade Yellowjacket ore into the mine design.

Exploration during 2014 has identified several favourable structural targets within the North Bullfrog land package that display the potential to host Yellowjacket style mineralization of high-grade vein systems. If the company is successful in discovering additional feeder zones, this could potentially to lead to a significant expansion of the current high-grade resource and a subsequent improvement in the economics of North Bullfrog. The 2015 drill program will commence this week and we should see results from the first phase program in the third quarter of the year. With potential high-grade resource expansion, improved metallurgical recoveries, and optimized mine design, the Corvus team is quietly developing North Bullfrog into a very attractive low-cost gold asset.

Bottom line

We can expect a steady flow of news during the year, which offers several potential catalysts to move the share price. The company is held by strong hands with management holding 8%, and both AngloGold and Tocqueville each holding 18%. Both Anglo and Tocqueville continue to back this promising story, having added to their positions in the most recent financing. If the company is able to expand their high-grade resources, and optimize their metallurgical recoveries, this would elevate the attractiveness of the project in this low metal price environment. The project is located in one of the best mining jurisdictions in the world, and in addition, the property contains excellent infrastructure, being adjacent to a major highway and power corridor, while the company also holds large water rights on the project.

Potential Catalysts and Events to Monitor:

- Yellowjacket Updated Resource Estimate (Q2 2015)

- Yellowjacket Initial PEA (Q2 2015)

- Phase I 2015 Core Drill Results (Q3 2015)

- Phase II 2015 Core Drill Results (Q4 2015)

APR