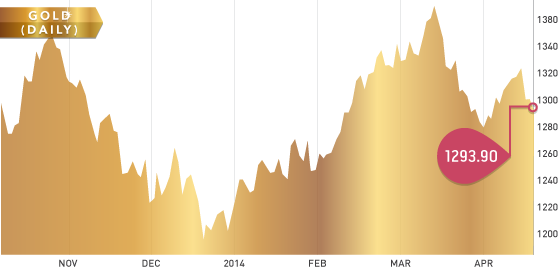

A little bit of volatility in the gold price this week occurred as gold closed on Thursday at $1294.60, down from the previous close at $1,318.40 per ounce. April 15th was an interesting day as gold dropped $27 to close just under $1,300. It appears three large sell orders caused the drop shortly after the New York market opened. On April 15th, 2013 gold dropped $130 in the trading session for no apparent reason. What is interesting is that April 15th is the day U.S. taxes are due, which leads me to the question: Is the gold drop a coincidence or is something else happening?

Gold Chart

A quick update on the strikes in South Africa: Platinum producers have come to the table with a new offer yesterday (April 17th) that would double the wages of the lowest paid workers in three years. Talks between the parties are expected to resume after the Easter weekend.

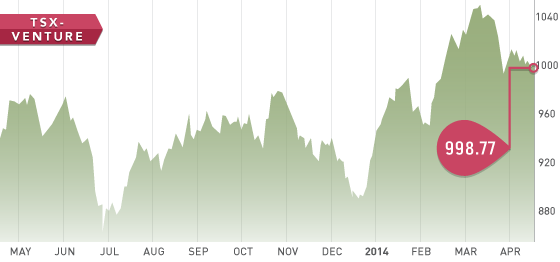

The TSX Venture continues to trade around the 1,000 level as we head into the second half of the month. It appears that the financing climate is slowing down from the beginning of the year. Junior mining companies are scrambling to pay audit fees, as annual financial statements are due at the end of this month.

TSX-V Chart

Africa gold producers have arrived in your inbox. Next up is an update on the three PGM producers followed by 17 Latin America producers.

Analyst portfolio performance: Year to date performance is still very strong at 19.3%. The top 5 are up 33%.

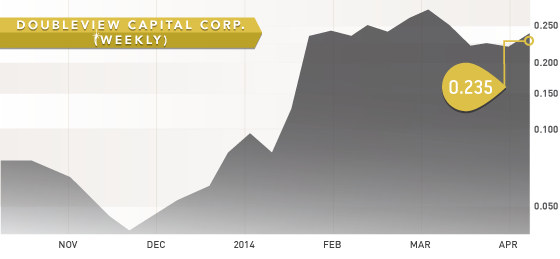

Symbol: DBV.V

Symbol: DBV.V

Price: $0.235

Shares Outstanding: 48,644,021

Market Cap: $9,729,000

Doubleview Capital is this edition’s stock of the week. In our TIckerscores Top 10 we highlighted a couple companies in the Sheslay camp in north-western British Columbia. Doubleview is another company in the region with the Hat Property bordering both Prosper Gold (PGX.V) and Garibaldi (GGI.V). Management at DBV is extremely aggressive and has already set up camp and commenced drilling in early April. Prosper and Garibaldi have been a little more patient and await better weather as there is still a considerable amount of snow on the ground. Investors should look for assays in the next 6-8 weeks. One thing to note is that management will need to finance again soon as they had < $1 million going into the drill program. CEO Farshad Shivani owns 14.4 million common shares, which shows his belief in this project. This is a very high-risk, high-reward exploration stock.

APR