| 80+ pages with in-depth analysis on management, projects, financials, and upcoming catalysts to move share price. | 100% independent and unbiased. We work for our subscribers only. | Profit from the market bottom in precious metals by choosing top tier companies. | Proven results: Our last report identified a takeover target (Cayden) that was bought for 42.5% premium. |

What will be included in the report?

In this special quarterly report, we cover the ten precious metals companies that we believe have the potential for the highest returns for investors. We choose these companies based on our Tickerscores scoring system and our analyst’s discretion. For each company, we highlight: management, insider ownership, financials, upcoming catalysts, and the risk climate. We also include relevant maps and visualizations to help investors understand the company.

How is this report 100% independent?

Companies do not pay us a dime. We use the proceeds from the report and Tickerscores memberships to cover our costs. The report is 100% independent and unbiased. This allows us to pick the stocks that we think are the best bet for speculators.

What kind of results can I expect?

Past results are not predictors of future success, but so far we have beat the TSX-V index with each of our last three reports. One of the companies included on our last report (Autumn 2014) was immediately taken out for a 42.5% premium (Cayden Resources), providing a hefty return to our subscribers.

For samples from our Summer 2014 report, go here and here.

I am a Tickerscores subscriber. Is it included?

Certainly. All current paid subscribers get our quarterly reports free of charge.

|

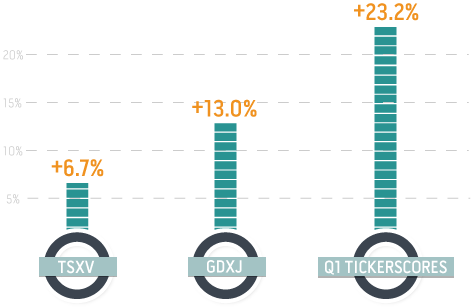

Our Return in Q1:

Our picks in Q1 2014 outperformed the GDXJ and TSX Venture by 10.2% and 16.5%, respectively. |

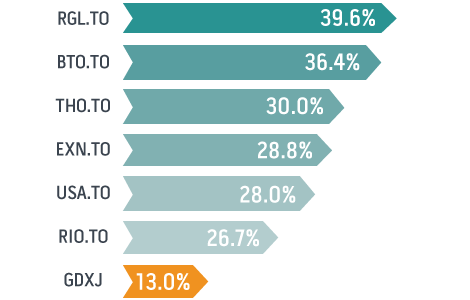

Our Q1 Picks:

6 of the 10 highest scoring companies covered by Tickerscores had returns over 25% in Q1 2014. |

|

| Our Tickerscores stock scoring system is the backbone of the report: we use our independent coverage of over 450 stocks to weed out the best companies to buy.

Tickerscores is empirical and unbiased. Our analysts have chosen the 10 companies with the highest scores and that have the most potential. As an example, in Q1 2014, 46 development companies scored over 60/100 in Tickerscores database. 38 of those companies had positive gains, with an average winning return of 38.6%. 10 companies gained more than 50% and 3 doubled. 23 exploration companies scored over 60/100 in Tickerscores. 16 of those companies had positive gains, with an average winning return of 43.4%. 6 companies returned over 50%, and 1 doubled. |

|

Disclaimer: Tickerscores is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Site users should always conduct their own research and due diligence and obtain professional advice before making any investment decision. Tickerscores will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our material special reports, email correspondence, or on our web site. Our readers are solely responsible for their own investment decisions.