40+ Pages

|

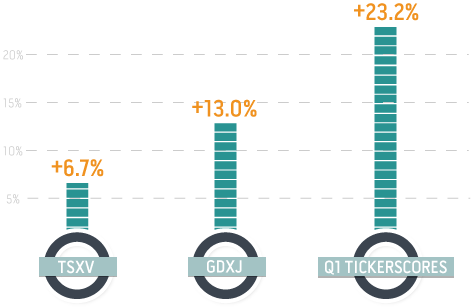

Beat GDXJ and TSXV

|

Double Digit Gains

|

100% Independent

|

| 40+ pages of in-depth analysis on management, projects, financials, and upcoming catalysts to move share price. | Q1 picks beat GDX-J and TSX-V by 10.2% and 16.5% respectively. |

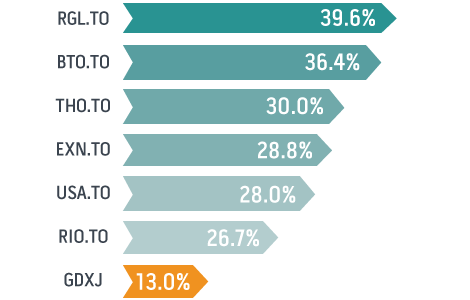

8 of our 10 picks had double-digit gains over Q1, and 6 gained more than 25%. |

100% independent and unbiased. |

We feature two exploration stocks from an area that we think will be the hottest for junior mining stock exploration this summer. Each of these companies has a tight share structure that could lead to explosive share price moves.

One of the companies previously found a 5 million ounce gold deposit. Initial drill results late last fall show promise for the potential of another large deposit.Insider ownership in both companies is extremely high with both CEO’s owning >9% of the common shares.

Each company is also well funded and ready to start an aggressive summer exploration program in the next few weeks.

A gold development company with a deposit that is well over 5 million ounces and located in a safe jurisdiction. A new resource estimate is due by the end of June followed by a PEA.

This company has $29 million in cash and eight drill rigs turning on the property right now. The deposit just keeps getting bigger as they extend the strike length.

This, in our opinion, is the best gold development takeover candidate in the entire space. Expect a takeover offer for this company in the next 6-18 months.

A small junior gold company that just commenced production in February. The mine was completed on time and under budget – a rarity in today’s mining world.

One of the most important things when investing in junior mining companies is the management. This company’s management would rank right at the top of the list. The last company this management team put together was acquired for 8.8X the initial capital invested. One institutional owner owns 80% of the common stock.

With a market cap of less than $100 million, this is almost as good as it gets. Production is expected to increase year over year as the deeper the pit goes the higher the grade material. One more thing this company has is no debt.

|

Our Return in Q1Our picks in Q1 outperformed the GDXJ and TSX Venture by 10.2% and 16.5%, respectively. |

Our Q1 Picks6 of the 10 highest scoring companies covered by Tickerscores had returns |

|

| garblegoop |  |